|

||

|

||

Co-authored by Lee Howard, Senior Vice President and Peter Tobey, Marketing and Communications Director at IPv4.Globa.

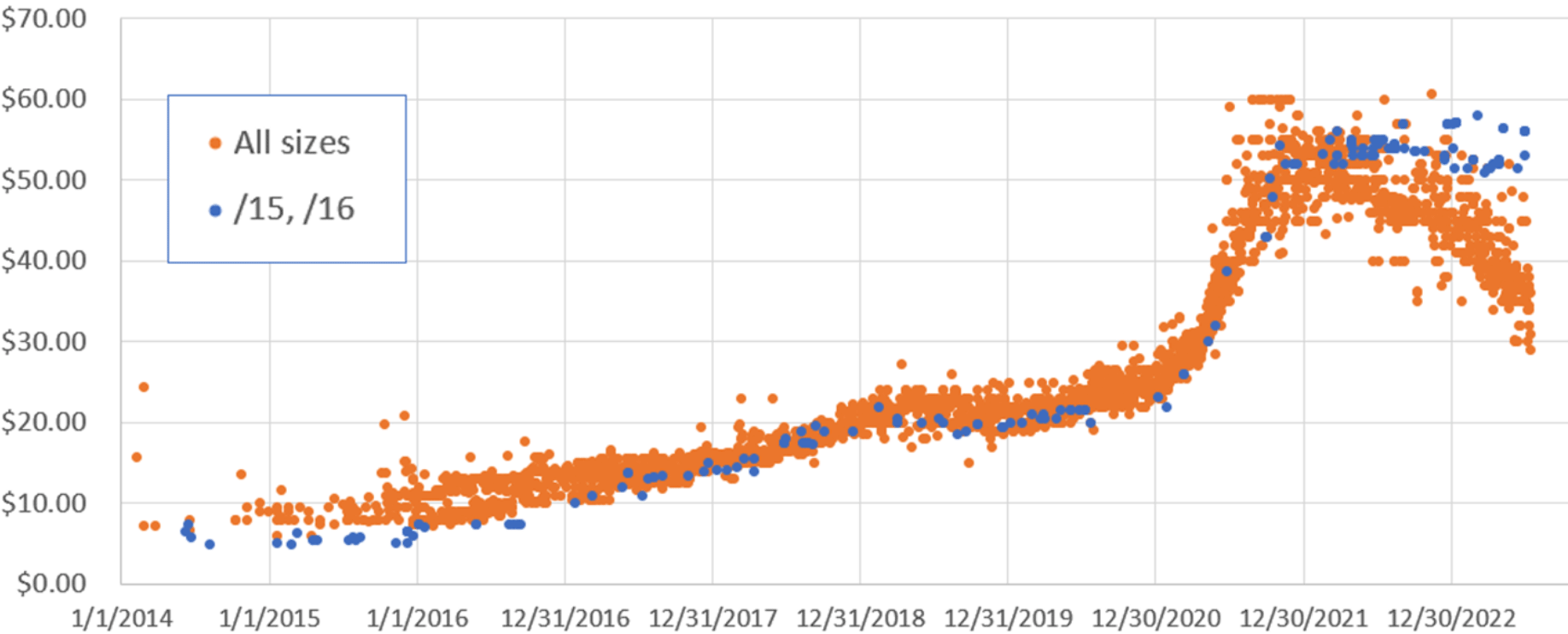

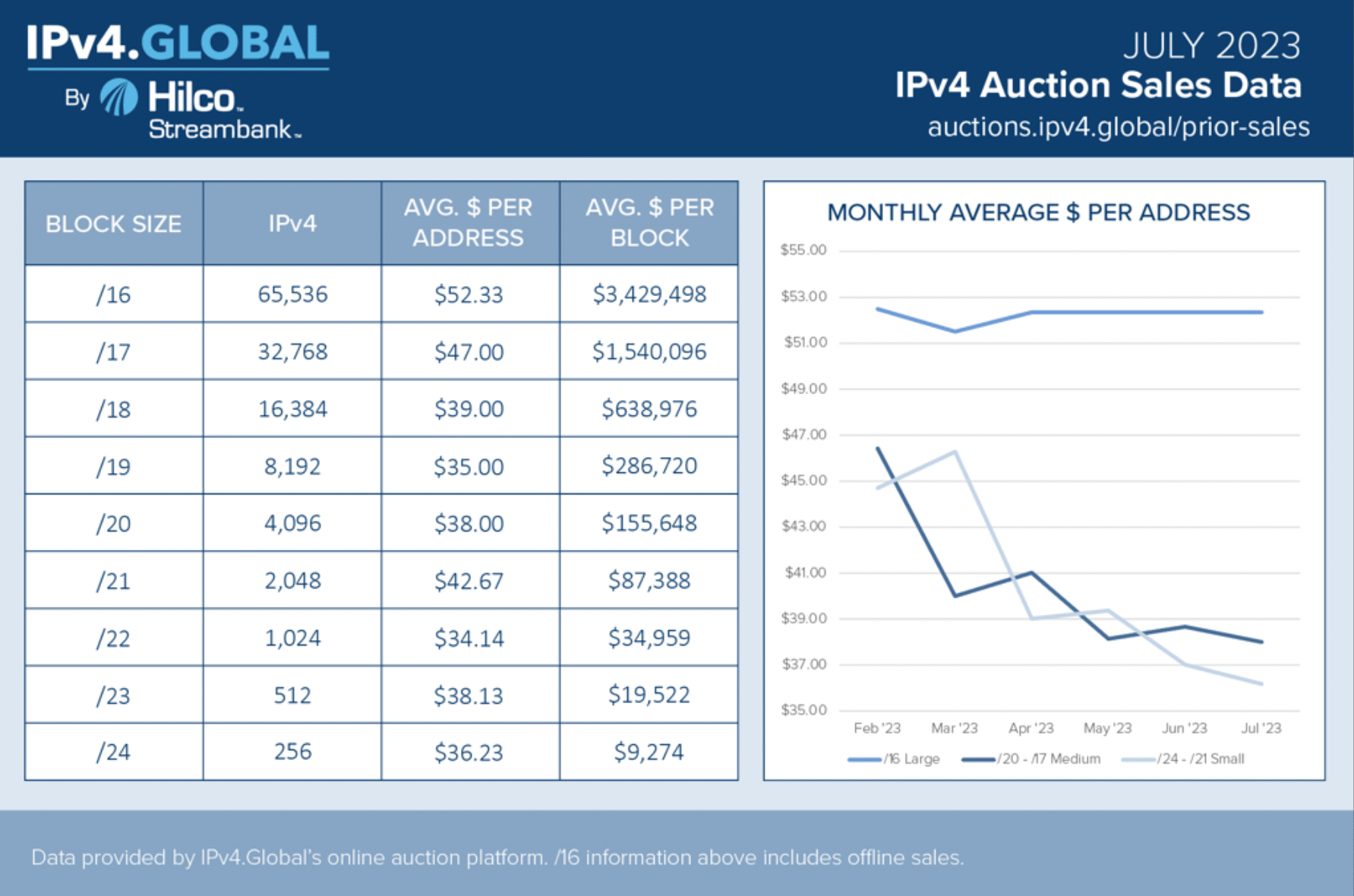

In early 2022 the discount that had been available for large blocks of IPv4 addresses disappeared. For the first time in years, /16 blocks and larger began to sell at an increasing premium. By Q2-2023, small and medium-sized blocks sold for a 30-35% discount to larger ones. At the same time, the tighter range of prices that had persisted for nearly a decade fractured and blocks traded in wide ranges throughout 2022 and the first half of 2023.

The bifurcation of the market is clearly between those /16-and-larger blocks and all smaller ones. The following graph illustrates the most recent price trends among small, medium and large blocks.

Considering long-term price trends, prices increased at a very steady rate 2014-2018, before flattening in 2019-2020 and then spiking in 2021. At this point, prices of small blocks have returned to where they would have been had the original (2015-2020) steady rate of increase simply continued.

Speculating on broad marketplace causes and effects is best introduced with caveats galore. Too often, correlation is mistaken for cause in any financial analysis.

The following describes one of several influences on IPv4 prices. Additional analyses are available on IPv4.GLOBAL’s blog, 2023: The First Half.

Many shrewd observers of the IPv4 market will opine that demand for this crucial element of network expansion varies independently of price for the addresses. That is: folks who need addresses buy them. The overall need for addresses is immediate and outweighs variation in price. Relatively small price variations don’t dampen the need in this theoretical scenario.

Of course, this does not always prevail. Those with multi-year expansions often have fixed maximums on their spending plans and will accelerate purchases when prices are low.

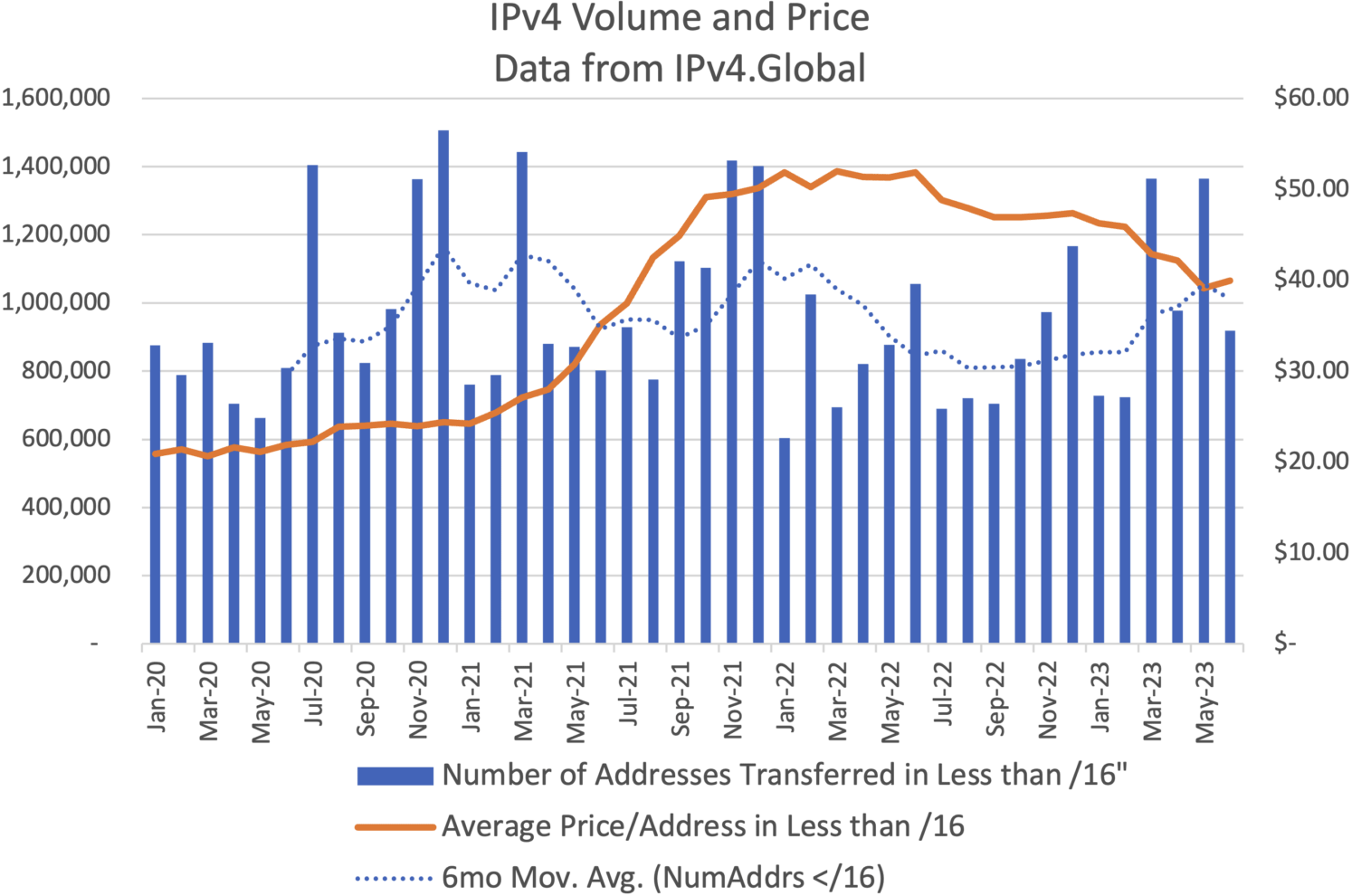

However, supply may very well influence pricing. And pricing impacts supply. Let’s look only at transfers smaller than /16, since the dynamics change at /16 and larger. Demand was low as network projects were put on hold during the pandemic lockdown but rose rapidly through 2021. Prices started to rise rapidly in early 2021, reflecting a lack of supply. Rising prices surely prompted some additional sellers to bring their addresses to market. But that price increase was followed by falling demand during most of 2022. Unquestionably, that reduced demand has resulted in falling prices.

During much of 2022 (and most dramatically during mid-year) blocks smaller than /16s experienced a decline in demand—and a natural trough in transfers resulted. As demand softened, prices at first stabilized and then declined. This end to rising prices and the long, slow trend of falling values began in October 2021 and has continued until today.

It is important to note that prices continued to rise for a time (Q4 2021) even as demand softened. Such lags in supply/demand relationships are not unusual. It is possible that future demand increases will be followed by price increases only after some similar delay in market reaction. Reporting is also a factor: Price changes are a leading indicator. Note that the price date is the date a sale is agreed upon, and the volume date is the date the transfer is complete, which is often weeks or even months later.

Beginning in March 2023, activity in these smaller block sizes increased. This trend is too recent and short-lived to draw sound conclusions from it. However, in connection with some possible stabilizing of small-block prices, one might speculate that rising small-block demand, and therefore the prices of them, may continue.

A Message from Our Sponsor

How to Take Advantage of Rising IPv4 Address Value: IPv4.Global specializes in helping clients sell, lease and buy IPv4. We help make the process less complicated and time-consuming by:

• Helping you find a buyer

• Leading you through the registry process

• Providing advice and expertise to reorganize your network

Contact us by calling (212) 610-5601 to speak with an expert for help turning your invisible asset into revenue.

Sponsored byVerisign

Sponsored byIPv4.Global

Sponsored byVerisign

Sponsored byRadix

Sponsored byWhoisXML API

Sponsored byDNIB.com

Sponsored byCSC