One of the biggest uses of bandwidth continues to be streaming video from the many online vendors like Netflix, Disney, Hulu, and many others. Final 2022 earnings reports show that this is an industry segment in crisis. Altogether, the losses for just these four video platforms were almost $11 billion in 2022. There are other big platforms like Apple, Google (YouTube), and Amazon that don't specifically report on the performance of the video streaming segment.

One of the biggest uses of bandwidth continues to be streaming video from the many online vendors like Netflix, Disney, Hulu, and many others. Final 2022 earnings reports show that this is an industry segment in crisis. Altogether, the losses for just these four video platforms were almost $11 billion in 2022. There are other big platforms like Apple, Google (YouTube), and Amazon that don't specifically report on the performance of the video streaming segment.

Traditional cable providers in the United States continue to lose cable TV customers at the same fast pace as the second quarter of the year. In the third quarter, the cable companies list 1.68 million customers after losing over 1.65 million customers in the second quarter. These numbers come from Leichtman Research Group, which compiles most of these numbers from the statistics provided to stockholders, except for Cox, which is privately held and estimated.

Traditional cable providers in the United States continue to lose cable TV customers at the same fast pace as the second quarter of the year. In the third quarter, the cable companies list 1.68 million customers after losing over 1.65 million customers in the second quarter. These numbers come from Leichtman Research Group, which compiles most of these numbers from the statistics provided to stockholders, except for Cox, which is privately held and estimated.

I saw recent headlines that claim that the time people watch streaming content is now greater than all of the time spent watching content from cable companies. A deeper look at the underlying statistics shows that this isn't entirely true, but it makes for a great headline. But it's still news that the percentage of viewing done through streaming continues to grow while the number of traditional cable customers continues to plunge.

I saw recent headlines that claim that the time people watch streaming content is now greater than all of the time spent watching content from cable companies. A deeper look at the underlying statistics shows that this isn't entirely true, but it makes for a great headline. But it's still news that the percentage of viewing done through streaming continues to grow while the number of traditional cable customers continues to plunge.

Nielsen recently published some statistics about how we watch videos that show a continuing trend of migration from traditional video to watching video online. One of the most striking statistics is the total volume of online videos. December 2021 saw an aggregate of 183 billion minutes of online video viewing. And even that, the number is likely small since there are many uses of video on the web that are not likely counted in the total.

Nielsen recently published some statistics about how we watch videos that show a continuing trend of migration from traditional video to watching video online. One of the most striking statistics is the total volume of online videos. December 2021 saw an aggregate of 183 billion minutes of online video viewing. And even that, the number is likely small since there are many uses of video on the web that are not likely counted in the total.

There have been rumors for years about merging Dish Networks and Direct TV to try to gain as much market synergy as possible for the two sinking businesses. It's hard to label these companies as failures just yet because between two companies collectively still had 21.8 million customers at the end of 2020 (DirectTV 13.0 million, Dish 8.8 million). This makes the two companies collectively the largest cable TV providers, with Comcast at 19.8 million and Charter at 16.2 million.

There have been rumors for years about merging Dish Networks and Direct TV to try to gain as much market synergy as possible for the two sinking businesses. It's hard to label these companies as failures just yet because between two companies collectively still had 21.8 million customers at the end of 2020 (DirectTV 13.0 million, Dish 8.8 million). This makes the two companies collectively the largest cable TV providers, with Comcast at 19.8 million and Charter at 16.2 million.

One of the obvious drivers of broadband usage is online video, and a study earlier this year by the Leichtman Research Group provides insight into the continuing role of video growth in broadband usage. The company conducted a nationwide poll in the US looking at how people watch video, and the results show that Americans have embraced online for-pay video services.

One of the obvious drivers of broadband usage is online video, and a study earlier this year by the Leichtman Research Group provides insight into the continuing role of video growth in broadband usage. The company conducted a nationwide poll in the US looking at how people watch video, and the results show that Americans have embraced online for-pay video services.

The final numbers are in for 2019 and the largest cable providers collectively lost over 5.9 million customers for the year - a loss of almost 7% of customers. The numbers below come from Leichtman Research Group which compiles these numbers from reports made to investors, except for Cox which is estimated. The numbers reported are for the largest cable providers, and Leichtman estimates that these companies represent 95% of all cable customers in the country.

The final numbers are in for 2019 and the largest cable providers collectively lost over 5.9 million customers for the year - a loss of almost 7% of customers. The numbers below come from Leichtman Research Group which compiles these numbers from reports made to investors, except for Cox which is estimated. The numbers reported are for the largest cable providers, and Leichtman estimates that these companies represent 95% of all cable customers in the country.

The last few weeks have reinforced the importance of modern communication networks to societies. Health care providers, schools, governments, and businesses all rely on networks that enable us to connect and collaborate remotely. Had we encountered a similar pandemic ten years ago, we would not have been able to continue our activities on the level that is possible today.

Measuring and managing subscriber bandwidth can be an easy and cost-efficient way to improve subscriber quality of experience (QoE). In a HFC cable network, bandwidth is shared among users in the same fiber-node. Even though improvements in DOCSIS technology has allowed a substantial increase of bandwidth availability per fiber-node, a few heavy users - as well as new 4K video content - can quickly kill recently-made network investments and leave subscribers with an impression that they are not receiving the quality they deserve.

Measuring and managing subscriber bandwidth can be an easy and cost-efficient way to improve subscriber quality of experience (QoE). In a HFC cable network, bandwidth is shared among users in the same fiber-node. Even though improvements in DOCSIS technology has allowed a substantial increase of bandwidth availability per fiber-node, a few heavy users - as well as new 4K video content - can quickly kill recently-made network investments and leave subscribers with an impression that they are not receiving the quality they deserve.

It has been widely taken as "obvious" that a "no blocking" rule for ISPs is a good regulatory policy. Is this really the case? Does it save consumers from harm... or cause harm? Netflix has reached the point of being well over 30% of Internet traffic at peak time for some ISPs. This places three costs on the ISP and its users... So for someone who isn't a streaming video user, they are paying a share of the direct costs.

It has been widely taken as "obvious" that a "no blocking" rule for ISPs is a good regulatory policy. Is this really the case? Does it save consumers from harm... or cause harm? Netflix has reached the point of being well over 30% of Internet traffic at peak time for some ISPs. This places three costs on the ISP and its users... So for someone who isn't a streaming video user, they are paying a share of the direct costs.

For people attending The Internet and Television Exchange (INTX), the redubbed Cable Show for 2015, enabling technologies are as important as always, but the transformation of business models in the video delivery industry has certainly cast a huge grip on an industry caught in the middle of a seismic change -- driven by ever-increasing broadband speeds, mobile access to content, and yes, disruptive Over-The-Top (OTT) offerings.

For people attending The Internet and Television Exchange (INTX), the redubbed Cable Show for 2015, enabling technologies are as important as always, but the transformation of business models in the video delivery industry has certainly cast a huge grip on an industry caught in the middle of a seismic change -- driven by ever-increasing broadband speeds, mobile access to content, and yes, disruptive Over-The-Top (OTT) offerings.

Sun, surf, and ... service operators? It's a match made in heaven! The Caribbean cable and telecommunications industry may not be large, but it is an important and fast-growing region. The recent Caribbean Cable & Telecommunications Association (CCTA) Annual Meeting in Puerto Rico threw the spotlight on this slice of paradise and I was there to catch up on some of the trends emerging for the year ahead.

Sun, surf, and ... service operators? It's a match made in heaven! The Caribbean cable and telecommunications industry may not be large, but it is an important and fast-growing region. The recent Caribbean Cable & Telecommunications Association (CCTA) Annual Meeting in Puerto Rico threw the spotlight on this slice of paradise and I was there to catch up on some of the trends emerging for the year ahead.

Expect a charm offensive as Comcast and scores of sponsored researchers explain how acquiring Time Warner Cable will promote competition and enhance consumer welfare. You might not hear too much about two traditional concerns remedied by actual facilities-based competition: incentives to innovate and reduce prices. Comcast will frame its acquisition as necessary to achieve even greater scale to compete with other sources of video content and maybe to compete with the limited other sources of broadband access.

Expect a charm offensive as Comcast and scores of sponsored researchers explain how acquiring Time Warner Cable will promote competition and enhance consumer welfare. You might not hear too much about two traditional concerns remedied by actual facilities-based competition: incentives to innovate and reduce prices. Comcast will frame its acquisition as necessary to achieve even greater scale to compete with other sources of video content and maybe to compete with the limited other sources of broadband access.

The principle behind Chromecast is probably the magic formula that is needed to finally revolutionise television watching. Google's latest product was launched yesterday... TV revolution didn't come from the traditional broadcasters or their suppliers. Everything developed by them has been aimed more at protecting their traditional business than at looking for completely new opportunities - truly new TV innovations will most certainly come from the direction that the broader market has taken since the arrival of the smartphones and the tablets.

The principle behind Chromecast is probably the magic formula that is needed to finally revolutionise television watching. Google's latest product was launched yesterday... TV revolution didn't come from the traditional broadcasters or their suppliers. Everything developed by them has been aimed more at protecting their traditional business than at looking for completely new opportunities - truly new TV innovations will most certainly come from the direction that the broader market has taken since the arrival of the smartphones and the tablets.

I had the opportunity this week to take part in the National Cable & Telecommunications Association (NCTA) Cable Show - a traveling show in the U.S. that took place in Washington, DC, this year... In the U.S. capital, it's difficult to avoid the topic of politics and its effects on the telecommunications industry. This was especially true during The Cable Show in light of recent news around communication monitoring, wiretapping, and how far it's going.

I had the opportunity this week to take part in the National Cable & Telecommunications Association (NCTA) Cable Show - a traveling show in the U.S. that took place in Washington, DC, this year... In the U.S. capital, it's difficult to avoid the topic of politics and its effects on the telecommunications industry. This was especially true during The Cable Show in light of recent news around communication monitoring, wiretapping, and how far it's going.

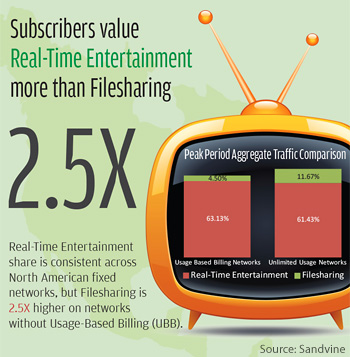

Video Dominates Internet Traffic As File Sharing Networks Overall Traffic Continues to Fall

Video Dominates Internet Traffic As File Sharing Networks Overall Traffic Continues to Fall Netflix Becomes Largest Source of Internet Traffic in North America

Netflix Becomes Largest Source of Internet Traffic in North America Cablecos Continue to Gain Telcom Market Share; Now at 15% and Growing

Cablecos Continue to Gain Telcom Market Share; Now at 15% and Growing Google CEO Discusses Future of the Web and Enterprise Computing

Google CEO Discusses Future of the Web and Enterprise Computing Americans Watched 21.4 Billion Videos in July, Largest Number Ever Recorded

Americans Watched 21.4 Billion Videos in July, Largest Number Ever Recorded Online Video Watching Among Young Adults Near-Universal; Nine in Ten

Online Video Watching Among Young Adults Near-Universal; Nine in Ten Annual Global IP Traffic Will Exceed Two-Third of a Zettabyte in 4 Years

Annual Global IP Traffic Will Exceed Two-Third of a Zettabyte in 4 Years Global IPTV to Reach 81 Million Users by 2013, 32% Annual Growth

Global IPTV to Reach 81 Million Users by 2013, 32% Annual Growth New Internet Study Finds Web and Streaming Higher Than P2P Traffic

New Internet Study Finds Web and Streaming Higher Than P2P Traffic Akamai Reports Record Streaming, Web Content on Obama’s Presidential Inauguration

Akamai Reports Record Streaming, Web Content on Obama’s Presidential Inauguration Google Predicting Next Ten Years of the Internet

Google Predicting Next Ten Years of the Internet