IPv4 Markets |

Sponsored by |

|

IPv4 leasing divides opinion as concerns over abuse, sustainability, and obsolescence persist. A recent IPXO webinar examined the evidence, challenging myths and advocating for transparency, flexibility, and cooperation in a shifting internet landscape.

IPv4 leasing divides opinion as concerns over abuse, sustainability, and obsolescence persist. A recent IPXO webinar examined the evidence, challenging myths and advocating for transparency, flexibility, and cooperation in a shifting internet landscape.

Outdated policies at Regional Internet Registries hinder the efficient transfer and leasing of IP addresses, driving up internet costs in emerging markets and limiting innovation. A faster, more inclusive governance model is urgently needed.

Outdated policies at Regional Internet Registries hinder the efficient transfer and leasing of IP addresses, driving up internet costs in emerging markets and limiting innovation. A faster, more inclusive governance model is urgently needed.

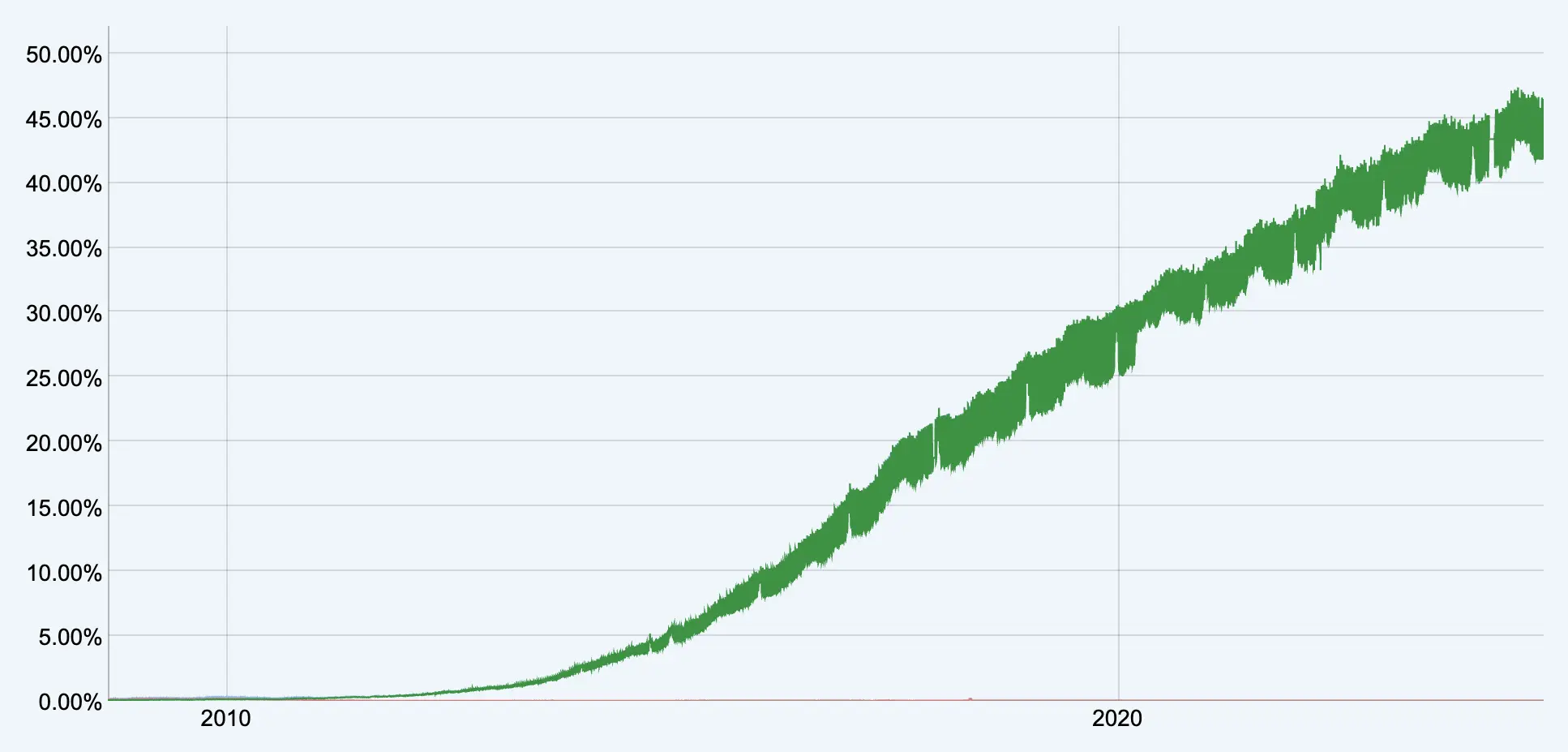

The Internet has evolved from a scarcity-driven system into one defined by abundance, reshaping infrastructure, governance, and economic models while challenging long-held assumptions about addressing, network roles, and the future of protocol design.

The Internet has evolved from a scarcity-driven system into one defined by abundance, reshaping infrastructure, governance, and economic models while challenging long-held assumptions about addressing, network roles, and the future of protocol design.

With IPv4 addresses fetching up to $30 apiece and IPv6 adoption lagging, companies may be sitting on hidden digital assets. A strategic audit could unlock unexpected revenue and enhance long-term infrastructure planning.

With IPv4 addresses fetching up to $30 apiece and IPv6 adoption lagging, companies may be sitting on hidden digital assets. A strategic audit could unlock unexpected revenue and enhance long-term infrastructure planning.

Diverging policies and fee structures among Regional Internet Registries are reshaping the global IPv4 market. RIPE has emerged as a liquidity hub, while others leak resources, risking long-term instability and financial fragility.

Diverging policies and fee structures among Regional Internet Registries are reshaping the global IPv4 market. RIPE has emerged as a liquidity hub, while others leak resources, risking long-term instability and financial fragility.

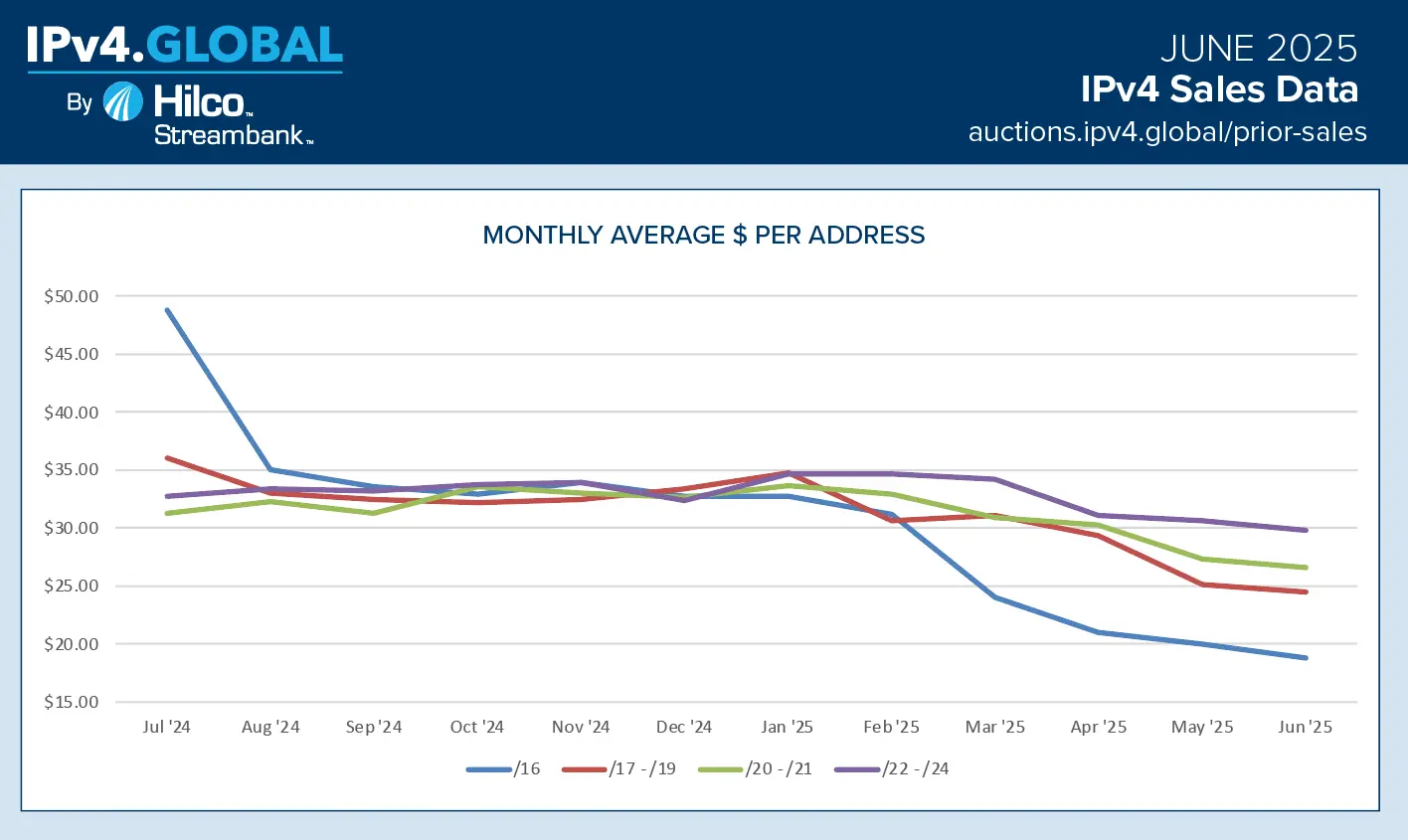

Through 2024, IPv4 leasing stayed steady at about $0.50 per IP per month, even as purchase prices diverged by block size. Large blocks (like /16) corrected notably while smaller blocks (/20 - /24) remained comparatively firm. That spread reflected shifting enterprise behavior (more surgical allocations, less speculative buying) and the resilience of subscription-like leasing in unstable conditions.

Through 2024, IPv4 leasing stayed steady at about $0.50 per IP per month, even as purchase prices diverged by block size. Large blocks (like /16) corrected notably while smaller blocks (/20 - /24) remained comparatively firm. That spread reflected shifting enterprise behavior (more surgical allocations, less speculative buying) and the resilience of subscription-like leasing in unstable conditions.

Between 2021 and 2023, the IPv4 market was a roller coaster ride - prices shot up in 2021, peaked in 2022, and plummeted in 2023. Those who expected a recovery in 2024 were sadly disappointed. Prices for IP addresses continued to decline, leveling out during the second half of the year. And yet, market activity remained remarkably unaffected - a sign, perhaps, that the market is settling into a new normal.

Between 2021 and 2023, the IPv4 market was a roller coaster ride - prices shot up in 2021, peaked in 2022, and plummeted in 2023. Those who expected a recovery in 2024 were sadly disappointed. Prices for IP addresses continued to decline, leveling out during the second half of the year. And yet, market activity remained remarkably unaffected - a sign, perhaps, that the market is settling into a new normal.

Cogent (CCOI) recently announced that it was offering secured notes for $206M. The unusual part is what it’s using as security: some of its IPv4 addresses and the leases on those IPv4 addresses... Cogent has been leasing out addresses for several years. All internet service providers (ISPs) give IP addresses to their users, but Cogent was among the first to lease those addresses independently of internet access.

Cogent (CCOI) recently announced that it was offering secured notes for $206M. The unusual part is what it’s using as security: some of its IPv4 addresses and the leases on those IPv4 addresses... Cogent has been leasing out addresses for several years. All internet service providers (ISPs) give IP addresses to their users, but Cogent was among the first to lease those addresses independently of internet access.

In 2021, the story was price. In 2022, the story was price and large block supply. The story in 2023 is decline -- but with a notable caveat. Spurred by unprecedented unit pricing, the North American IPv4 market in 2022 experienced its second-best year in terms of overall traded volume, and in both 2022 and in 2023, large block market activity was as robust as ever, with sellers trading large blocks at over $50 per number.

In 2021, the story was price. In 2022, the story was price and large block supply. The story in 2023 is decline -- but with a notable caveat. Spurred by unprecedented unit pricing, the North American IPv4 market in 2022 experienced its second-best year in terms of overall traded volume, and in both 2022 and in 2023, large block market activity was as robust as ever, with sellers trading large blocks at over $50 per number.

The IPv4 market has created serious interest in the protocol far beyond the natural confines of networking professionals. These assets are worth a lot. Marketplaces, IPv4.Global's especially, have grown to be large centers of asset transfer by buyers and sellers of IPv4 addresses. IPv4.Global has helped transfer over $1 billion in IPv4 blocks.

The IPv4 market has created serious interest in the protocol far beyond the natural confines of networking professionals. These assets are worth a lot. Marketplaces, IPv4.Global's especially, have grown to be large centers of asset transfer by buyers and sellers of IPv4 addresses. IPv4.Global has helped transfer over $1 billion in IPv4 blocks.

An IPv4 address identifies your connection to the online world. IP addresses make it possible to host websites, manage secure communication, and engage in countless other essential, internet-related activities. Typically, when migrating to a new cloud provider, a business has only one path: lease the provider's IP addresses. But what if a business already has a block of IP addresses?

An IPv4 address identifies your connection to the online world. IP addresses make it possible to host websites, manage secure communication, and engage in countless other essential, internet-related activities. Typically, when migrating to a new cloud provider, a business has only one path: lease the provider's IP addresses. But what if a business already has a block of IP addresses?

In a rapidly evolving digital landscape, the value of IP addresses has surged to the forefront of discussions. Over a month ago, Amazon Web Services (AWS) made a pivotal announcement, reshaping the IP address pricing landscape. Citing the escalating costs of acquiring IP addresses on secondary markets, AWS declared a fundamental shift in its pricing strategy, set to take effect on February 1, 2024.

In a rapidly evolving digital landscape, the value of IP addresses has surged to the forefront of discussions. Over a month ago, Amazon Web Services (AWS) made a pivotal announcement, reshaping the IP address pricing landscape. Citing the escalating costs of acquiring IP addresses on secondary markets, AWS declared a fundamental shift in its pricing strategy, set to take effect on February 1, 2024.

In early 2022 the discount that had been available for large blocks of IPv4 addresses disappeared. For the first time in years, /16 blocks and larger began to sell at an increasing premium. By Q2-2023, small and medium-sized blocks sold for a 30-35% discount to larger ones. At the same time, the tighter range of prices that had persisted for nearly a decade fractured and blocks traded in wide ranges throughout 2022 and the first half of 2023.

In early 2022 the discount that had been available for large blocks of IPv4 addresses disappeared. For the first time in years, /16 blocks and larger began to sell at an increasing premium. By Q2-2023, small and medium-sized blocks sold for a 30-35% discount to larger ones. At the same time, the tighter range of prices that had persisted for nearly a decade fractured and blocks traded in wide ranges throughout 2022 and the first half of 2023.

The Regional Internet Registry (RIR) for the Asia-Pacific region (APNIC) recently held its 55th meeting in conjunction with APRICOT, from 20 February to 2 March 2023, in Manila, USA. One of the critical discussions at the conference was centered on the APNIC policy that does not accept IP leasing and has a questionable understanding of its necessity. According to the APNIC policy manual, which was referenced during the meeting, APNIC allocates and assigns resources based on need, and 'leasing is not allowed' nor does it form a basis for further need.

The Regional Internet Registry (RIR) for the Asia-Pacific region (APNIC) recently held its 55th meeting in conjunction with APRICOT, from 20 February to 2 March 2023, in Manila, USA. One of the critical discussions at the conference was centered on the APNIC policy that does not accept IP leasing and has a questionable understanding of its necessity. According to the APNIC policy manual, which was referenced during the meeting, APNIC allocates and assigns resources based on need, and 'leasing is not allowed' nor does it form a basis for further need.

In 2021, the story was price. In 2022, the story was price and large block supply. Spurred by unprecedented unit pricing, the IPv4 market in North America experienced its second-best year ever in market history. Nearly double the number of IPv4 addresses were traded in 2022 compared to 2021, predominantly due to the increased flow of large block supply from twelve sellers, five of whom were first-time market participants.

In 2021, the story was price. In 2022, the story was price and large block supply. Spurred by unprecedented unit pricing, the IPv4 market in North America experienced its second-best year ever in market history. Nearly double the number of IPv4 addresses were traded in 2022 compared to 2021, predominantly due to the increased flow of large block supply from twelve sellers, five of whom were first-time market participants.

IPv6 Transition Stalls as Internet Moves Beyond IP Addresses

IPv6 Transition Stalls as Internet Moves Beyond IP Addresses Close to 735K Fraudulently Obtained IP Addresses Have Been Uncovered and Revoked, ARIN Reveals

Close to 735K Fraudulently Obtained IP Addresses Have Been Uncovered and Revoked, ARIN RevealsIPv4 address prices continued their gradual decline in November, with small and medium blocks narrowing the gap with large blocks. Despite falling prices, transaction volume and buyer demand remain strong heading into 2026. more

IPv4 address prices continued to decline through Q3 2025, yet steady demand and strong supply are keeping the market active. Smaller blocks remain more resilient as larger allocations face sharper pricing pressure. more

IPv4.Global, part of Hilco Global's Capital Solutions division, today announced the relaunch of ProVision, the advanced network automation platform trusted by enterprises and service providers to simplify and scale critical infrastructure management. more

The IPv4 market continues to demonstrate healthy activity as August figures point to sustained transaction volume and steady pricing across most block sizes. Buyers and sellers alike remain engaged, with pricing dynamics showing signs of alignment across the spectrum. more

The market for IPv4 addresses, already constrained by finite supply is undergoing a period of subtle yet significant transition. Data from IPv4.Global's July 2025 report reveals a continuing decline in average prices per address - particularly among larger blocks - even as transaction volume sees a notable surge. more

After years of steady ascent, the market for IPv4 addresses is experiencing an uncharacteristic softening. According to new data from IPv4.Global by Hilco Streambank, the average monthly price per address has declined across all block sizes, with the most striking plunge seen in the larger /16 blocks. more

The market for IPv4 addresses continues to experience deflationary pressures, with recent data showing a steady decline in prices across all block sizes. According to May 2025 figures from IPv4.Global by Hilco Streambank, average prices per address have been trending downward for nearly a year, with large blocks - particularly /16s - leading the descent. more