|

||

|

||

Predicting rational behavior on the part of market participants invites two problems into the resulting projections. First, people almost always include some element of irrational thinking in their decisions. Second, no predictor can know every variable—even only the rational ones—or weigh those they know with perfect accuracy.

So, good predictions are good guesses made by experienced market observers. At IPv4.GLOBAL, we consider ourselves unusually well exposed to the marketplace and so, well-informed about its works. These are our guesses about the future.

During the past twelve months, supply of IPv4 addresses has outpaced demand. The IPv4.GLOBAL marketplace—the largest and so most-representative in the world—now lists over 200 blocks for sale where in the recent past, this number was 50 offerings. Some of this supply may be the result of several connected influences.

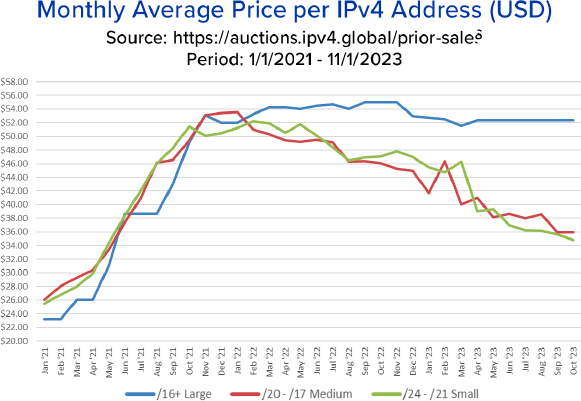

During the past three years IPv4 prices have, overall, risen. These higher prices enticed reluctant sellers into the market, especially as economic stress following the pandemic moved organizations to monetize available assets. At the same time, network operators, aware of the increased value of IPv4 inventory, have focused on efficiency. More efficient networks lead to more unused inventory that is available for sale and reduces the demand for additional address space.

We do not anticipate any change in either of these two factors.

Beginning in early 2022, IPv4 address prices have inverted: large blocks are selling for more than smaller ones. Since then, they have also diverged, with the difference between small to mid-size blocks and larger ones becoming very significant. The per-block price of large blocks currently hovers at $52 per IP address, and smaller blocks change hands at +/- $36.

While some premium for large blocks is reasonable in light of their relative scarcity, the difference in price between small and large blocks appears to be larger than could be expected. The significance—some say irrationality—of the spread shown above is unlikely to persist.

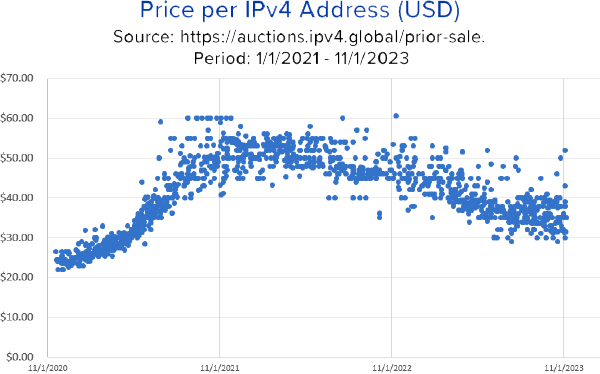

The above illustrates an associated-but-different phenomena: Prices have not simply diverged, separating large block prices from all others, they’ve scattered. Until mid-2021, all IP addresses traded in a fairly narrow price range. There was some significant difference between large blocks and all others (large blocks commanding lower prices per IP address). But the per address price difference among all address block sizes was small and individual blocks within any given class traded very consistently.

The 2021 and thereafter scattering of prices for smaller blocks has continued. That is the variability of pricing, even among recent transfers of the same block size, can be quite different. Today, we regularly see small-block transactions varying from $30 to $40 per IP address in the same week.

We expect to see the broad price difference between large blocks and all others reduced in the next twelve months as prices converge. This disparity will be closed either by falling large-block prices, rising small and mid-size prices, or a combination of both. It should be noted that recently, small and mid-size block prices appear to have stabilized, perhaps in anticipation of a recovery.

Put differently, the per-IP price of a /16 is currently 50% higher than the per-IP price of a /17. While there is an understandably greater value to the larger block to sizable networks, this disparity is greater than we expect will be the case in the long run.

Resisting any fall in the price of large blocks, seller expectations may prove sticky. During the past two years, supply appears to have expanded, probably in response to higher prices. It is difficult to predict how those expectations will slow or otherwise resist the changes outlined above.

Finally, it remains likely that the variety of prices currently traded for small and mid-size blocks will persist. The result is likely to be a consolidated but still broad band of per IP prices going forward.

AWS has announced they will begin charging for every IPv4 address an account is allocated or using on the platform, starting February 1, 2024. That’s a change from the current scheme, which only charges for addresses a customer reserves, but aren’t using, or if the account reassigns the same address over a hundred times a month. We expect Alibaba, Cloudflare, Google, and Oracle to have similar policies or plans.

With AWS’s price over $40 per address per year, we expect businesses to buy addresses on the market and bring them to the cloud. This will noticeably increase demand, especially among small blocks. That increase will contribute to the continuing stabilization of these blocks’ prices and/or their increase.

In sum, we expect prices to—overall —remain stable but the disparity in pricing among different block sizes to be reduced. Price increases may occur, overall, but we expect them to be small and result in broadly converging prices across all block sizes.

Sponsored byVerisign

Sponsored byCSC

Sponsored byVerisign

Sponsored byDNIB.com

Sponsored byWhoisXML API

Sponsored byIPv4.Global

Sponsored byRadix