|

||

|

||

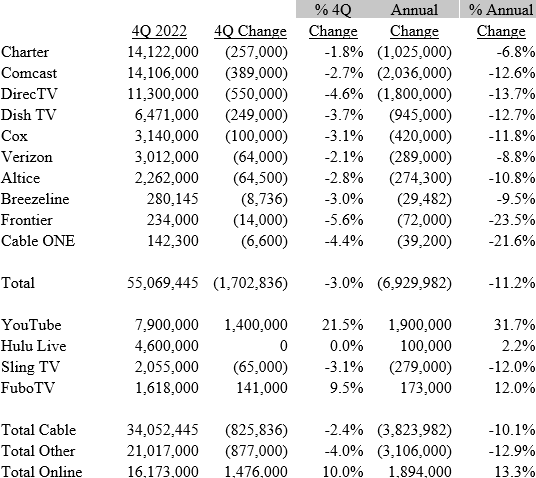

Leichtman Research Group recently released the cable customer counts for the largest providers of traditional cable service at the end of 2023. LRG compiles most of these numbers from the statistics provided to stockholders, except for Cox and Mediacom—they now combine an estimate for both companies. Leichtman says this group of companies represents 96% of all traditional U.S. cable customers.

I suspect there are regular blog readers who wonder why I post these statistics every quarter. There are several reasons.

The traditional cable providers continue to lose customers at a torrid pace, losing 1.7 million customers in the third quarter. Overall, traditional cable providers lost over 18,700 customers every day during the quarter. The overall penetration of traditional cable TV is now down to 42% of all households, down from 73% at the end of 2017.

In the fourth quarter, Comcast dropped from being the large cable provider and fell below Charter. Losses were big across the board, and only Charter, Verizon, and Breezeline lost less than 10% of the cable customer base for the year. The traditional cable providers lost over 6.9 million cable customers for the year—with only a fourth of those customers choosing an online cable substitute.

In the fourth quarter, online cable substitutes like YouTube and Hulu Live picked up 1,476,000 customers, almost all by YouTube. For the year, these providers added almost 1.9 million customers.

Sponsored byDNIB.com

Sponsored byCSC

Sponsored byIPv4.Global

Sponsored byVerisign

Sponsored byWhoisXML API

Sponsored byVerisign

Sponsored byRadix

Most of the people I know who have “cut the cord” haven’t really done so but just canceled their cable TV service. They still buy Internet service from the same company. But there are a lot of people who get all their Internet service through their mobile provider, and personally I couldn’t function this way. If my kids had to work from home during COVID and they had to use a mobile-connected Chromebook or something like that I wouldn’t expect good results.