|

||

|

||

RIPE held a community meeting in May in Rotterdam. There were a number of presentations that sparked my interest, but rather than write my impressions in a single lengthy note, I thought I would just take a couple of topics and use a shorter, and hopefully more readable bite-sized format.

Here’s the first of these bite-sized notes from the RIPE 86 meeting, on the topic of the Eu Gigabit Connectivity initiative.

Rudolph van der Berg presented on the latest updates from the ongoing tensions in the Internet industry between carriage infrastructure providers and content providers, with a European perspective. The carriage providers in the EU region are asserting that they’re making major capital investments in augmenting the access network infrastructure to carry gigabit traffic volumes, which is largely streaming content, while at the same time the content providers were getting a free ride, or so goes the argument. They are lobbying for some form of regulatory intervention in this market to force some content providers to contribute to their costs in building this infrastructure.

This is not a new tension in the communications industry, and it has enjoyed a rich history not only in context of the Internet but in telephony and goes further back into in the larger context of common carriage. We saw the arguments articulated in the numerous rounds of the Net Neutrality debate in the debate, where decisions appeared to oscillate one way and the other as the matter was considered by the US Federal Communications Commission and the US Federal court system. The same tension surfaced in in South Korea, where local courts firstly resolved the dispute in favour of the content streamer, and some years later resolved a similar dispute in favour of the access provider. This debate has resurfaced in the European context.

It’s a big stakes fight in so far as the larger content providers with their global business footprint see a loss in one regulatory regime as a template for all the other regulatory regimes to copy, so each time this resurfaces it becomes a point of focus for the large content providers. It’s also a high stakes issue for the access providers. Large scale carriage access involves high initial capital outlays (wires in the ground, spectrum licenses, satellite constellations) and generating returns on that capital over an extended period thereafter. Changes in the service model may impact on those expectations of capital returns, which in turn is reflected in the costs of carrying that sunk capital asset. Many of the carriers would like to phrase this as a problem with existential implications for their enterprise.

At the same time there is strong public sector pressure to maintain and even increase the level of capital investment. National communities want ubiquitous deployment of 5G mobile infrastructure and are already eyeing off 6G technology. The time of copper-based wired access networks is over, and the desire is to provide ubiquitous fixed line access using fibre optic infrastructure. To put it another way, governments now want national gigabit infrastructure for their nation, wired and wireless.

The rationale for EU interest in this topic is an assumption that the region with the competitively advantageous digital innovation will be the region with the best connectivity. The EU Digital Decade policy program wants to specify a target for all EU users to have access to gigabit network capabilities right up to the network termination point. “Gigabit for All” is the catchy summary of this objective. This is to be implemented with programs such as the Gigabit Infrastructure Act to make it easier to roll out gigabit access networks with a single portal to obtain permits and access to public infrastructure (such as ducts and poles, for example).

This program is also taking a stance on the long-standing tensions between carriage and content providers, proposing that all market actors should make a fair and proportionate contribution to the provision of public goods, services, and infrastructure in the EU. It’s hard not to interpret this EU program and it specific mention of all market actors as a clear notice of intention to the US content steamers, notably Google, Meta, Netflix, Apple, Amazon and Microsoft, that there will be a cost impost on their operations within the scope of this program.

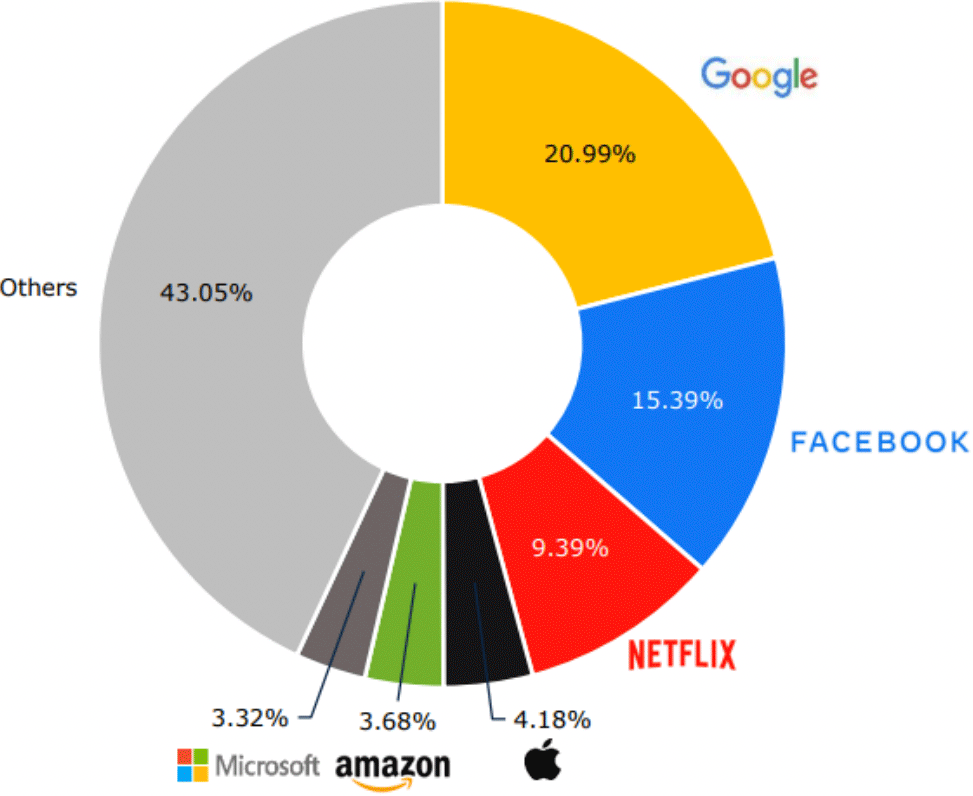

The annual cost of fixed and mobile network infrastructure is apparently some €55B per year in the EU region, and if these 6 enterprises generate some 60% of consumed traffic by volume, which appears to be the current figure (Figure 1), then a proportionate cost allocation would amount to a demand of some €35B per year.

If some 60% of carried traffic in EU access networks is OTT (over-the-top) traffic from a streamer to the end client, then a restoration of the old telephony inter-provider financial settlement model, where the sending party pays for end-to-end carriage, would seem to be an ideal scenario from the perspective of these access network providers.

Any such restoration of a sender-pays regime in the inter-provider space is unlikely to occur without regulatory intervention. The network operators assert that the current situation features asymmetric bargaining power and no compensating regulatory framework, so that access network operators are unable to negotiate a fair (in their eyes) outcome where the OTTs pay the network operator to deliver this OTT-sourced traffic to the network’s customers. Both the GSMA and ETNO are pushing hard for an EU position that any content source that delivers more than 5% of peak traffic load should pay EU access providers for their traffic to be delivered to EU customers. This would redress the worst of the imbalances in the current market and provide the carriers with access to capital streams that could be used to build the next generation of high-speed access infrastructure in the EU.

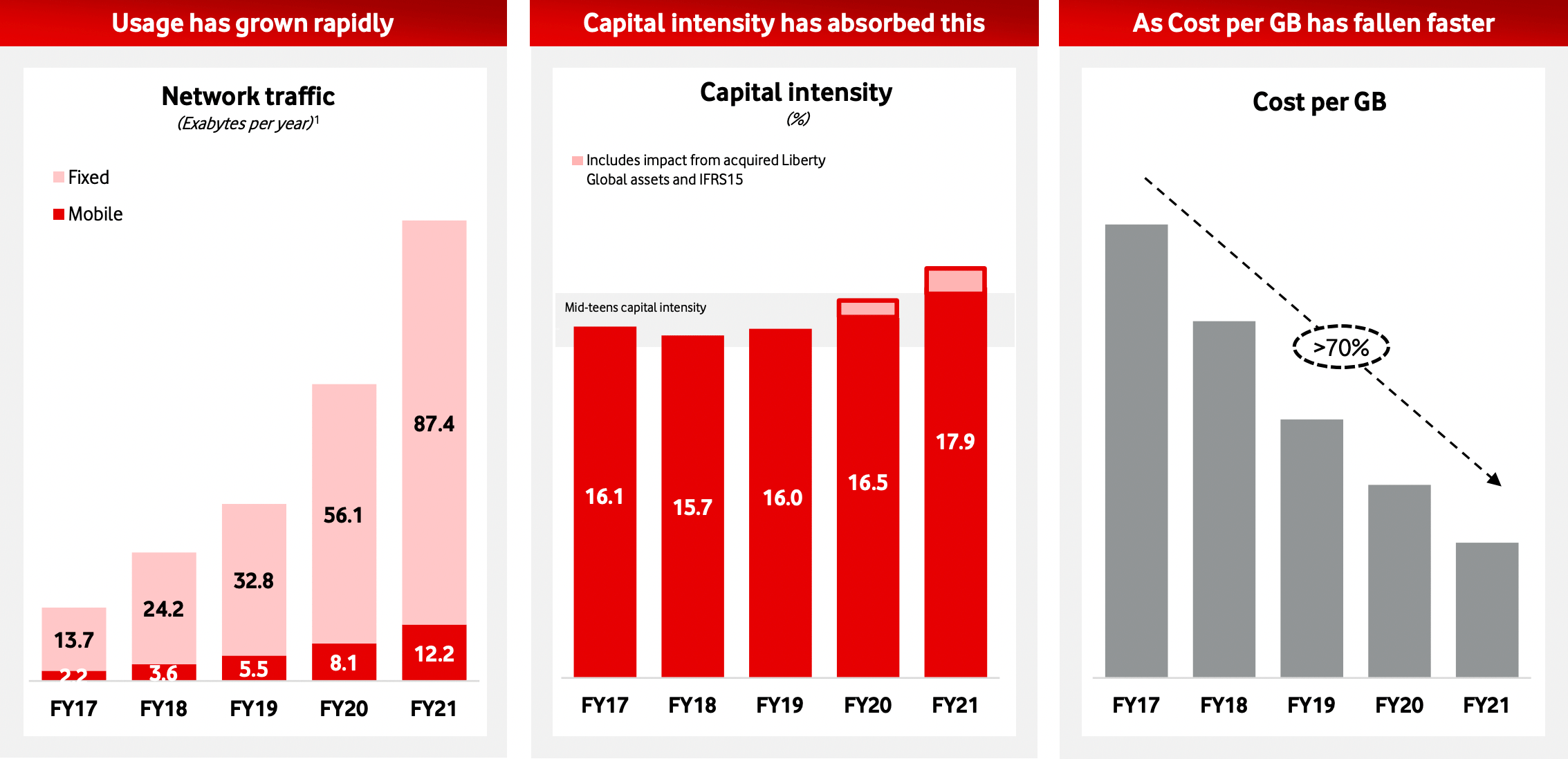

However, there is an assumption going on here that the increasing traffic volumes in these access networks drives increasing costs within the carriage business, and this is a questionable assumption. Vodaphone has reported to its investors that while network traffic volumes have increased significantly over the past 4 years, the level of capital investment has remained relatively steady as the cost per delivered Gb has fallen at a similar rate to the increase in traffic volume (Figure2).

Not only does this financial analysis contradict the assumption that increased traffic volumes necessarily impose increased capex costs on the carrier, the calls for the adoption of a sender pays inter-provider settlement regime along similar lines to the old inter-telco settlements strike a highly discordant note.

From the US perspective, it appears that part of the rationale for withholding the Internet from the ITU-T in the late 1980’s was the manner with which the sender-pays position in the telco sector had been thoroughly compromised and corrupted by individual telcos! The local provider’s termination monopoly weas ruthlessly exploited, and any outcome that produced better service and lower prices to consumers was entirely unrelated to the sender-pays model. Sender Pays became a source of significant inefficiency in the telco industry.

Such structural inefficiencies in inter-provider relationships resulted in higher costs to consumers and did not motivate service improvements. There is no reason to believe that a resurrection of this sender-pays model on the Internet as the means of interchange between content and carriage providers will generate a different outcome.

If the European telcos get their way here it won’t be an enabler of a more efficient and effective digital infrastructure for Europe. A far more likely outcome is simply the imposition of higher costs without any incremental benefits to consumers. Everyone in the EU will simply pay more, according to Rudolph.

And as for the aspirations of undertaking a program of competitively advantageous digital innovation in the EU, the prospects for this regional program look like collapsing in yet another round of trans-Atlantic bickering.

Sponsored byCSC

Sponsored byRadix

Sponsored byDNIB.com

Sponsored byVerisign

Sponsored byWhoisXML API

Sponsored byVerisign

Sponsored byIPv4.Global