|

||

|

||

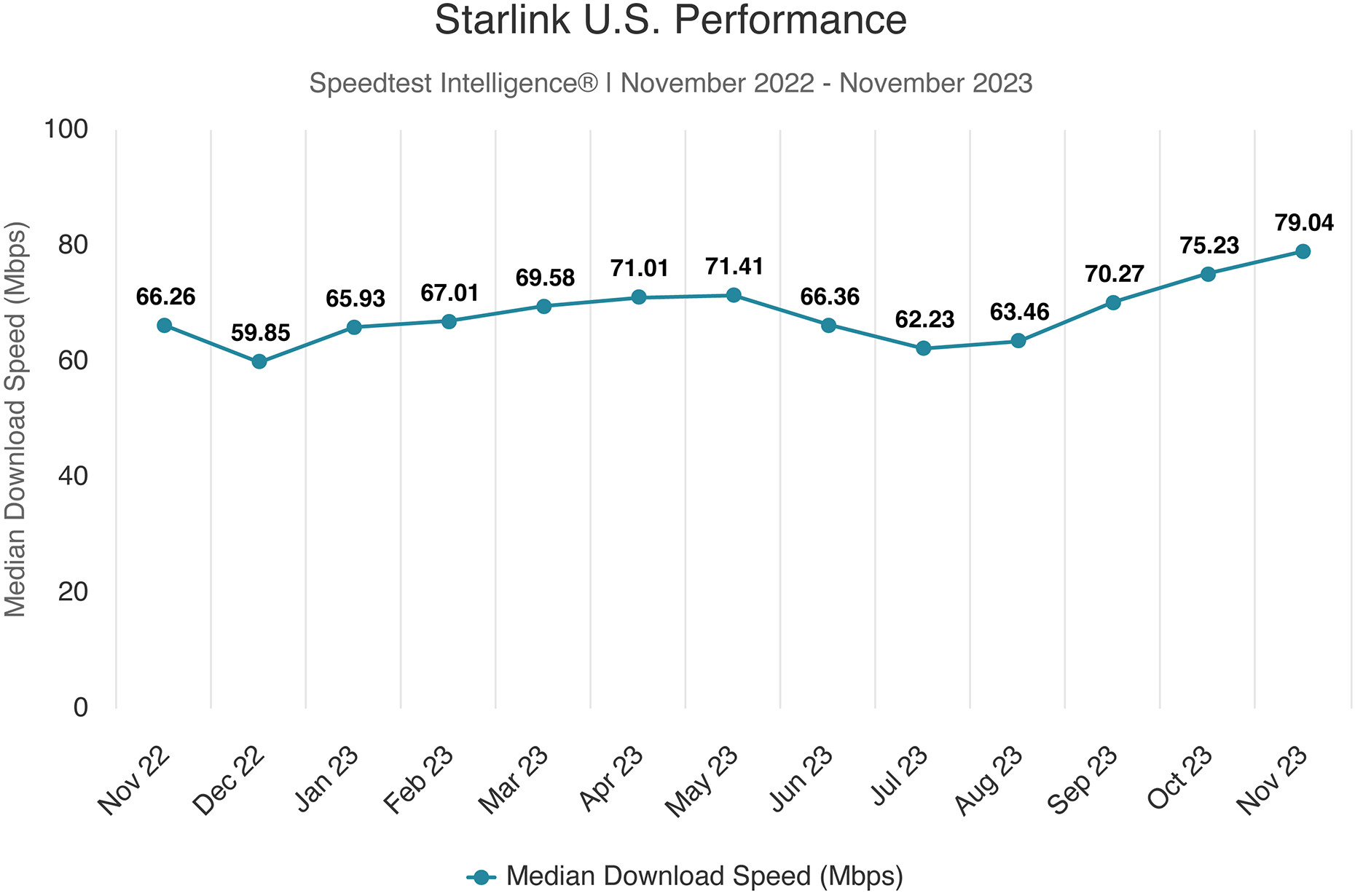

Ookla recently published a blog that looks at the speed performance of satellite broadband, focusing mostly on Starlink. I haven’t looked at this broadband sector for a while and thought it was time for an update.

Starlink has had a busy year. At the end of November, the company had 5,500 satellites in orbit, up from over 3,200 at the end of 2022. The first constellation is still slated to reach almost 12,000 satellites, and the company has tentative permission from the FCC to extend to 42,000. We’re about to start seeing the balancing act of launching new satellites while replacing older ones, as some of the original satellites are being decommissioned and are falling from orbit. The company has upgraded its satellites, and the newest ones weigh three times more than the original fleet.

Customers are obviously liking the bandwidth, and Starlink passed 2 million worldwide customers in September 2023. The Wall Street Journal reported earlier this year that the company has started to make a small monthly profit, an important step in long-term viability. The FCC recently, in response to a challenge by the company, reiterated that it would not be giving Starlink any of the $900 million the company won in the RDOF reverse auction at the end of 2020.

Ookla provides interesting statistics.

High-orbit geosynchronous satellites are not performing as well as Starlink. The median speed test in the third quarter for HughesNet was 15.87 Mbps, and Viasat was 34.72 Mbps. The real differentiator between these companies and Starlink is the latency, with the high-orbit satellites having a median latency well above 500 milliseconds, while Starlink’s performance is similar to cable companies.

The biggest problem that I hear from Starlink users is the price; with a base price of $110 per month, many people are paying $120 since they live in regions that have a lot of Starlink subscribers. I also know several folks who tried the technology and abandoned it—all lived in heavy woods and were never able to find a configuration that would deliver reliable broadband. I’ve also been seeing reports during the year on surveys where customers say the broadband suffers during rainy weather.

An interesting new player will soon enter the market—Project Kuiper, backed by Jeff Bezos. After multiple delays, the company finally launched its first two test satellites in 2023. The company is still optimistic about selling broadband in two or three years and has reserved numerous launch windows with rocket companies. The company has been moot on broadband pricing, but it wouldn’t be surprising to see the company come up with interesting bundling packages that include Amazon.

The biggest threat to U.S. satellite broadband is still a few year away. Much of the rural areas that the satellite ISPs do well in will see new broadband networks constructed with BEAD and other broadband grants. It’s going to be hard to keep customers priced at $110 per month when faster alternatives will be available for less. Of course, the rural U.S. is only a tiny portion of the worldwide market for Starlink and other satellite providers, and in the long run, it probably doesn’t matter how they do here. We live in a world where several billion people still don’t have any access to broadband—so the growth potential is gigantic.

Sponsored byVerisign

Sponsored byIPv4.Global

Sponsored byDNIB.com

Sponsored byCSC

Sponsored byRadix

Sponsored byWhoisXML API

Sponsored byVerisign