|

||

|

||

Amazon’s Project Kuiper is far behind Starlink and is under time pressure, but Amazon has several things going for it.

In 2019, I wrote that Amazon would be a formidable satellite-ISP competitor. I still think so, but I didn’t expect it would be over four years until they launched the first test satellites. In the meantime, SpaceX has put over 5,000 satellites in orbit and has over two million Starlink customers.

Amazon has permission to launch 3,236 satellites. They must manufacture and launch at least half of them by July 2026 and the remainder by July 2029. Can they do it? After many delays, they have finally launched two test satellites, confirming that inter-satellite laser links (ISLLs) worked at 100 Gbps while sending traffic “in both directions from the internet over an AWS fiber-optic connection to our ground gateway station, up to our satellites, and then down to a customer terminal at our test location.” All Starlink satellites launched since September 2021 will have ISLLs, so by the time Kuiper is complete, July 2026, all or nearly all Starlink sats will have them and they will have a much larger constellation.

Amazon has not launched any production satellites, and they will have to hurry to meet the 2026 and 2029 deadlines. They have signed contracts for 83 launches over a five-year period, which they say will provide capacity for “the majority” of the constellation. SpaceX was conspicuously not one of the vendors, and a shareholder lawsuit pointed out that Amazon had not considered SpaceX as a provider and nearly 45% of the overall value is for launches and engines from Blue Origin, a rocket company founded by Jeff Bezos. Subsequently, Kuiper signed a 3-launch contract with SpaceX.

(Note that Blue Origin has not yet launched their forthcoming New Glenn rocket, which was initially scheduled to fly in 2020. The New Glenn will have greater capacity than SpaceX’s current Falcon rocket but significantly less than their forthcoming Starship).

Amazon’s Project Kuiper is far behind Starlink and is under time pressure, but Amazon has several things going for it:

I could go on, but you get the idea—I think Kuiper will survive despite a rocky start and will eventually offer Starlink healthy competition.

Update Feb 9, 2024:

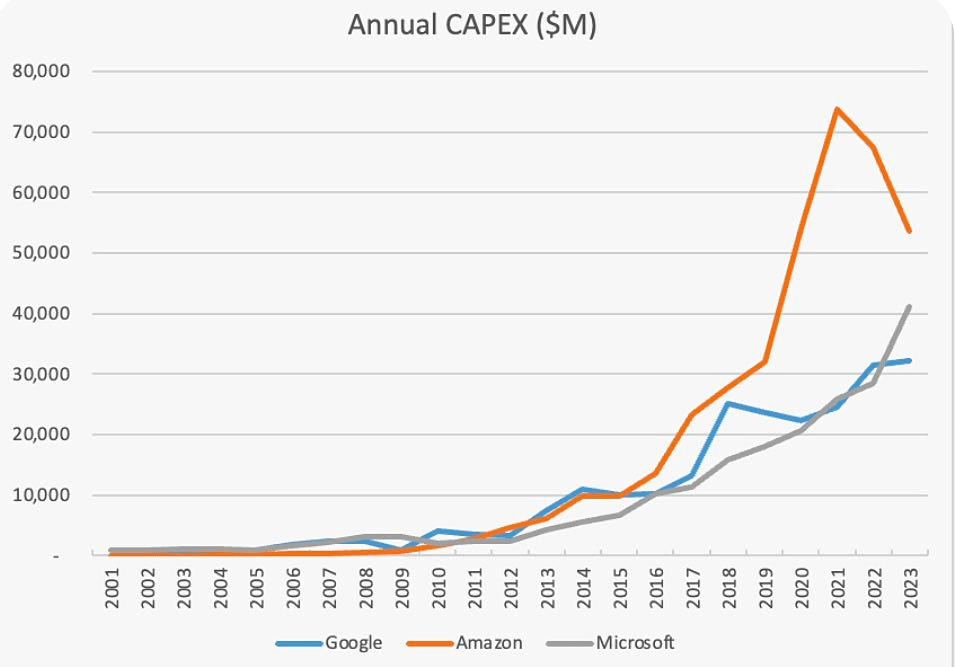

I listed Jeff Bezos’s wealth and the expected use of the Kuiper constellation among the causes of my optimism. A report on the capital expenditures by the three major cloud service companies puts Amazon’s commitment to invest $10 billion over several years in Project Kuiper in context. In 2023 alone “Amazon’s (relative) CAPEX austerity continues, as the company spent a measly $53.7 billion, a decline of 20%” and it has invested around $380 billion since 2000.

Update May 26, 2025:

Amazon launched its first batch of production satellites on April 28, 18 months and 22 days after its test satellites. (Starlink launched production satellites 15 months after its test satellites.) It remains to be seen whether they can meet the FCC deadlines for having 3,216 satellites in operation by July 2029 and half that by July 2026.

If they fail to meet one or both deadlines, they will request a delay and may face political pressure from SpaceX. Amazon’s Jeff Bezos has made Trump-friendly editorial changes at the Washington Post and supported Trump financially, but has not paid as much as Elon Musk. Both had VIP seats at Trump’s inauguration along with Mark Zuckerberg, Sundar Pichai, and Tim Cook.

Update Jul 16, 2025:

SpaceX launched a batch of 24 Project Kuiper satellites, bringing the constellation up to 78 satellites in orbit.

Amazon has contracts with United Launch Alliance for 47 launches, Blue Origin for 12 with options for 15 more, Arianespace for 18 launches, and only two more launches from SpaceX, which are expected to take place this year.

The small SpaceX contact was precipitated by a lawsuit filed in 2023 claiming that Jeff Bezos and Amazon CEO Andy Jassy “consciously and intentionally breached their most basic fiduciary responsibilities” by not selecting any launches that used the Falcon 9 rocket, “the most obvious and affordable launch provider, SpaceX, from its procurement process because of Bezos’ personal rivalry with Musk.”

Sponsored byVerisign

Sponsored byCSC

Sponsored byWhoisXML API

Sponsored byDNIB.com

Sponsored byRadix

Sponsored byIPv4.Global

Sponsored byVerisign