|

||

|

||

China’s plans for low-Earth orbit Internet service constellations began with two projects, Hongyun (156 satellites) and Hongyan (864 satellites). These were eventually sidelined for Guowang, an ambitious, 12,992 satellite constellation that is expected to begin launching satellites this year. But, that is old news.

China’s five-year plan designates satellite Internet as a strategic emerging industry and two new constellations have emerged, G60 (12,000 satellites) and Honghu-3 (10,000 satellites).

Shanghai Spacecom Satellite Technology (SSST), aka Yuanxin Satellite, located in Shanghai’s Songjiang district, was founded in 2018 and launched two test satellites in 2019. SSST recently raised 6.7 billion yuan ($943 million) from several sources for its 12,000 satellite G60 (aka Qianfan) low Earth orbit (LEO) Internet service constellation. (Also see this excellent context video).

Their first phase constellation, called Sailspace, will consist of 1,296 satellites. Regional service will be provided by 648 satellites by the end of 2025 global service will be provided by 648 additional satellites by the end of 2027. By 2030, they hope to have 15,000 satellites in orbit and offer direct-to-mobile service. Shanghai Gesi Aerospace has begun production of the G60 satellites and expects to produce 300/year. (Also see). I’ve not heard any news about Guowang lately—it feels like G60 has taken the lead. (Also see).

The satellites will orbit at 1,160 km, which is higher than all the other announced LEO satellite competitors except Telesat (see: SpaceX Starlink vs. Telesat Lightspeed and Will Telesat Survive?). While this will increase latency, collision risk, satellite lifespan, handoff frequency, and coverage footprint should improve.

Like SSST, Shanghai Landspace Hongqing Technology Co, Ltd. (aka Hongqing Technology) is located in the Songjian District and is planning a third Internet service constellation. The May 24th ITU filing lists the satellite name as “HONGHU-3,” but specifies a constellation of 10,000 satellites in 160 orbital planes. Since they have launched two satellites previously, the constellation may simply be called “Honghu.” They are constructing a satellite manufacturing facility in Wuxi City near Shanghai. The Chinese launch company Landspace owns 48% so, like SpaceX, they may launch their own satellites.

It is not a coincidence that both Honghu and G60 are being developed in the G60 Science and Technology Innovation Corridor between Highway G60 and a high-speed railway line in the Yangtze River Delta (Also see). Local governments play a major role in funding and developing Chinese industry. Shanghai has published “The Shanghai Action Plan to Promote Commercial Space Development and Create a Space Information Industry Highland (2023-2025)”.

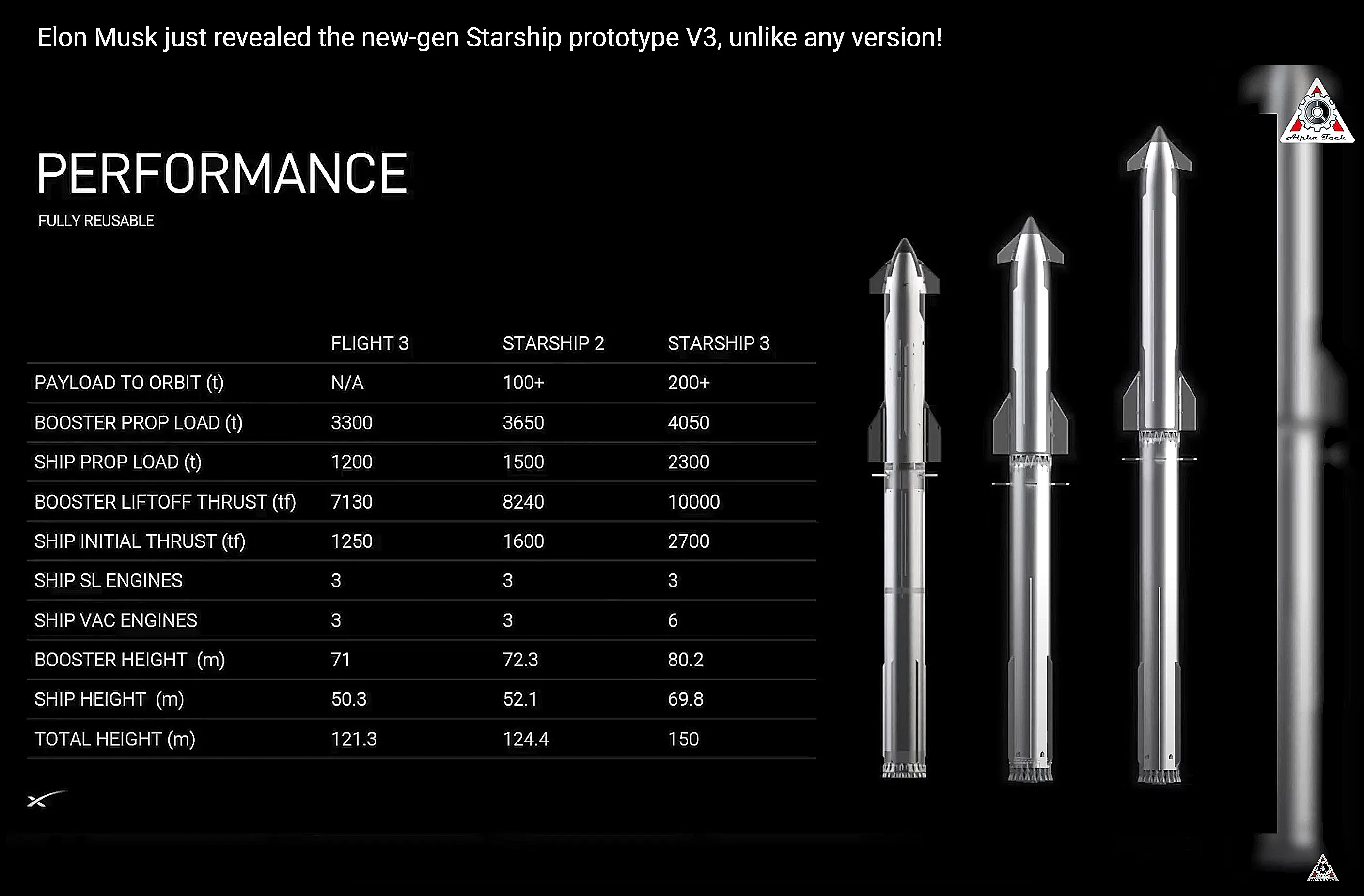

These companies are commonly touted as China’s answer to Starlink, but they are far behind Starlink in launch cost and rate, rocket and engine manufacturing, international licensing, marketing, etc. The gap will widen when SpaceX’s Starship is in production, increasing the ability to launch full and mini v2 satellites and whatever comes after that.

However, the success of these companies will not depend solely on catching or competing with Starlink because of global politics. The Chinese companies will not compete with Starlink or any of its Western competitors for Chinese government and military business. (The Ukraine war has demonstrated both the military value of satellite Internet and the drawback of being dependent on a private company).

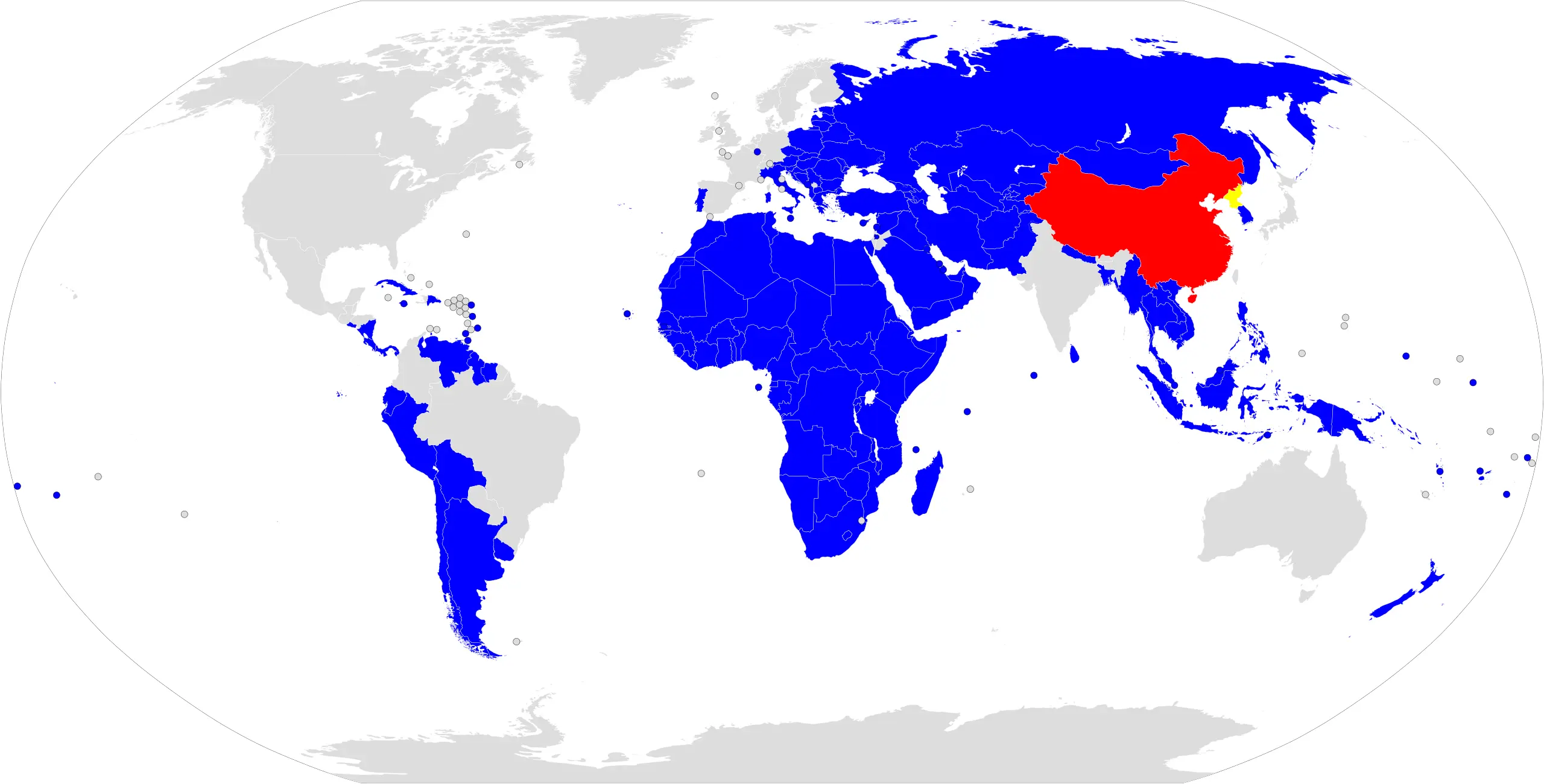

Starlink will not offer service in countries like China, Russia, Cuba, North Korea, or Iran. Similarly, the Chinese companies will be prohibited from operating in countries like the US and European nations which currently ban or restrict Huawei equipment. Whether motivated by a desire to encourage domestic industry, promote security, or achieve and maintain technological self-reliance, market separation is increasing.

However, there are many nations where these Chinese companies will compete with Starlink and its Western competitors. The Chinese companies will have an advantage in nations participating in the Belt and Road Initiative—home to about 70% of the world population and 40% of global GDP. The Chinese advantage is even greater in the 26 Digital Silk Road nations.

Update Jun 27, 2024:

China is expected to launch the first 18 G60 satellites in early August. The launch vehicle was not specified, but “the Long March 6A would be the most capable option from Taiyuan in terms of capacity to low Earth orbit and payload fairing.”

The Long March 6A has a carrying capacity to orbit of 4,500 kg, which could accommodate 18 250 kg satellites, around the mass of the first generation SpaceX Starlink satellites, but significantly less than the V2-mini satellites Starlink is currently launching. SpaceX is currently testing its forthcoming Starship rocket which will launch full V2 satellites.

While China lags far behind SpaceX, G60 seems to be moving faster than Honghu and Gwowang and will be launching satellites sooner than Project Kuiper or Telesat.

Update Aug 5, 2024:

China has launched the first 18 Qianfan (aka G60) Internet service satellites:

The satellites launched were produced by Shanghai Gesi Aerospace Technology (Genesat) in Shanghai and In an interview with the Shanghai Securities News in June, an executive from GeneSat revealed plans to “explore launching configurations of 36 and 54 satellites per rocket to accelerate the pace of launches”.

What launch vehicles are they considering? Non-Chinese perhaps?

Update Aug 29, 2024:

GSTL satellite factory Ace China-space watcher Blaine Curcio has spotted a possible dark-horse Chinese communication satellite provider. CGSTL, China’s leading remote sensing satellite manufacturer, has built and and launched ~100 satellites in 2 years and been working on space-ground optical communication since 2022.

CGSTL aims to have 1,200 employees, and a manufacturing capacity of 1,000 satellites per year by the end of 2025. They plan to launch 28 remote sensing satellites in 2025 and 100 in 2026—what will they use the 1,000 satellites per year manufacturing capacity for? Will they launch their own communication satellite constellation or perhaps manufacture satellites for one of the service providers mentioned above? Something else?

Update Oct 31, 2024:

The second batch of 18 G60 satellites was launched into polar orbit on a Long March 6A rocket. (They plan to have 108 in orbit by the end of the year, 648 by 2025, 1,296 by 2027, and 15,000 by 2030.). This image shows workers racing to protect a Long March 8 fairing at Hainan commercial spaceport from an approaching typhoon. The lettering says “Spacesail,” another name for the G60 constellation.

This is noteworthy because the Long March 8’s carrying capacity is greater than that of the Long March 6A, and Starlink’s launch capacity and cadence are much greater than those of the Chinese. (While the Long March 8 is not reusable, several Chinese companies are working toward reusability).

G60 and the Long March 6A have also had other problems. The upper stage of the rocket that carried the first 18 satellites to orbit broke up creating a cloud of roughly 700 pieces of debris and astronomers are concerned by the brightness of the first 18 satellites.

Update Dec 5, 2024:

Thousand Sails constellation operator SpaceSail has signed an MoU with Brazil’s TELEBRAS for its Internet service starting in 2026. This is their first commercial agreement, and they have initiated business negotiations with more than 30 countries. Brazil is one of the nine BRICS countries which are economically tied to China.

Update Dec 9, 2024:

Eighteen Thousand Sails satellites, weighing about 300 kg, have been launched bringing the constellation up to 54 satellites. While they have had problems with debris, no issues were reported with this launch.

The dark blue nations on this map are targeted for marketing in 2025 and the light blue for 2026. As reported above, they already have a memorandum of understanding with Brazil.

Update Jan 8, 2025:

In his 2024 Year in Review, Blaine Curcio reports that Chinese “commercial space continues to grow by leaps and bounds, buffetted by government support and renewed investor interest in the sector” and as major constellations like GeeSpace and Thousand Sails pick up momentum they “create real demand for launchers, satellite systems manufacturers, and other suppliers.”

The biggest 2024 funding round “by far” was for Sailspace’s Thousand Sails constellation. The ¥6.7B funding round mentioned above ended up being “the world’s largest” and, in December, Sailspace’s manufacturer Gensat announced a ¥1B funding round to ramp up production. Curcio did not report the exact amount of GeeSpace financing. I queried four AI chatbots and none knew of any 2024 financing—Geely is probably able to fund satellite manufacturing and launch on its own.

Update Mar 12, 2025:

SpaceSail has launched 18 new satellites, bringing the Qianfan Constellation’s total to 90 in orbit. They are in near-Polar orbits ranging in altitude from 800 to 1,070 kilometers.

The launch was at China’s first commercial launch site, the Hainan International Commercial Aerospace Launch Center. This launch went smoothly, without the kinds of problems they have had in previous launches. It was also streamed on the Internet and you can see a portion of the video and some still photos here.

Update June 9, 2025:

Thousand Sails manufacturer Genesat (aka CGSTL) plans to invest 1.2 billion yuan in its second factory project. It will have a pulsation production line capacity of 150 ton-level satellites per year or a batch production capacity of 300 satellites under 500 kg per year. Note that both are larger than the 267 kg first-generation satellites, and their production capacities are consistent with Blaine Curcio’s mass estimates of 400-500 kg and 1.5 tons for the second and third generation satellites.

Update Aug 17, 2025:

It’s been a year since the first Qianfan launch, but five months since the last one. Is the slowdown due to satellite or launch availability, or are they pausing for some redesign? The upper stage of the first launch fragmented, creating over 300 pieces of trackable debris. Ninety satellites are in orbit, but fourteen have not reached their operational altitude. Furthermore, the satellites are interfering with astronomy and some are tumbling. Regardless of the cause for delays, Qianfan is unlikely to meet its ITU launch deadlines.

Sponsored byVerisign

Sponsored byVerisign

Sponsored byDNIB.com

Sponsored byWhoisXML API

Sponsored byIPv4.Global

Sponsored byRadix

Sponsored byCSC