|

||

|

||

Afnic, the association responsible for several Internet Top Level Domains, including the .fr country-code Top Level Domain, has published the 2022 edition of its annual analysis under the title “The Global Domain Name Market.” Here are some highlights of this study.

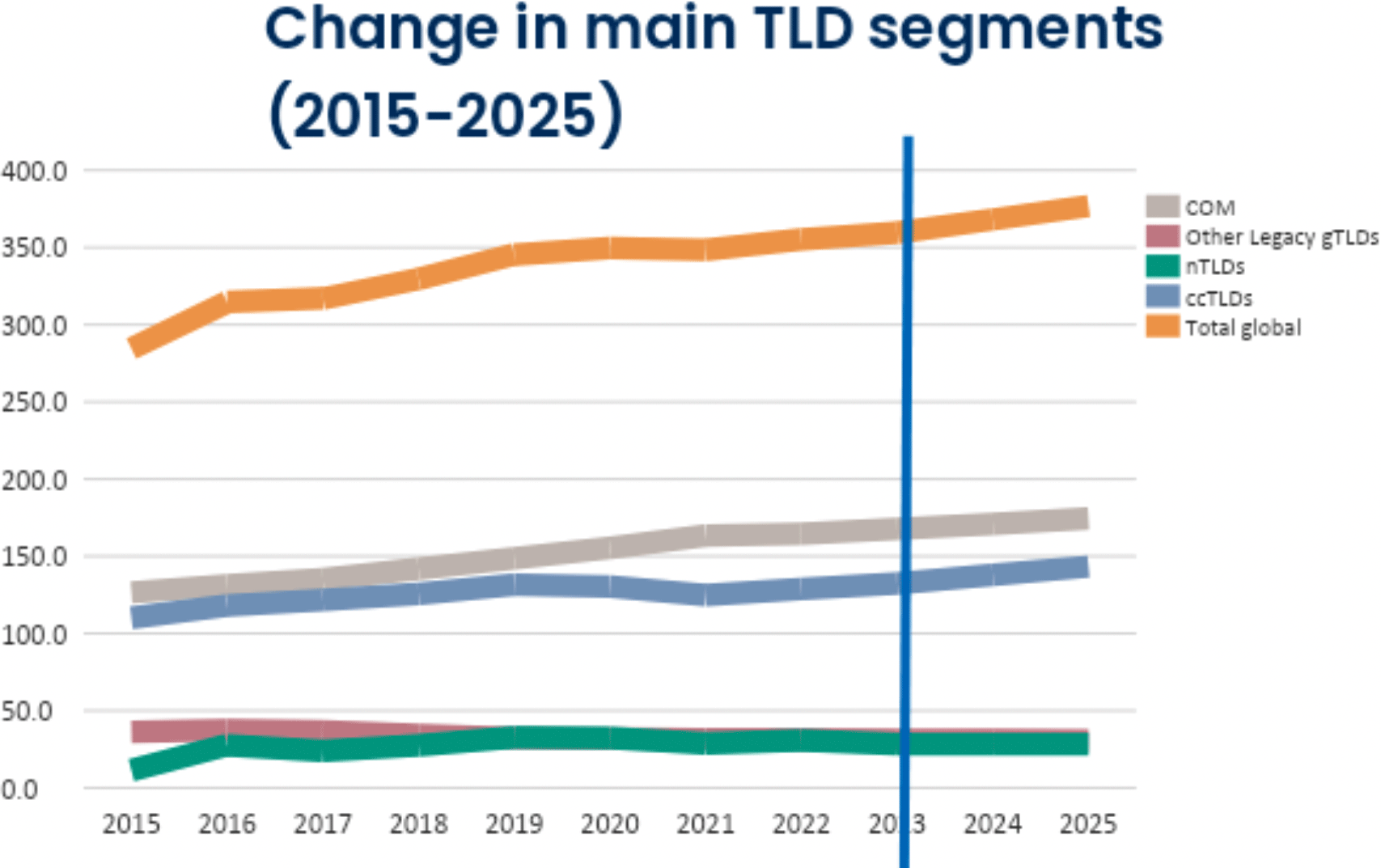

The domain name market posted aggregate growth of +1.9% in 2022, an acceleration that reflects a break in the trend observed since 2019. As we foresaw in last year’s report, 2021 was the “trough” year, with a relative improvement over 2022.

At end of 2022, the global domain name market represented some 355 million domain names, up +1.9% on 2021, a surge in growth compared to the two previous years (+0.9% in 2021 vs. 2020 and +1.3% in 2020 vs. 2019).

The .com TLD was hit hard in 2022, posting two-quarters of losses for the first time in its history. But this may well be linked just as much to the post-COVID return to normal as to the effect of its price increases in 2021 and 2022 or the tense international situation. There were 164 million .com domains at the end of 2022, an increase of just +1.1% compared with 2021. The .com TLD also lost one percentage point of market share (down from 47% in 2021 to 46% in 2022). Despite this, .com continues to dominate the market, both in terms of volume (it accounts for 83% of all Legacy TLDs) and growth (all other major Legacy TLDs, excluding .org, are losing stock). Since the retention rate remains stable, the lack of movement in the .com domain in 2022 is due, above all, to the fall in its create operations.

There were 31 million Other Legacy TLDs (generic TLDs created before 2014) at year-end 2022, down by -0.8% compared with 2021 and on the back of a previous decline in 2021 (0.7% vs. 2020) and in 2020 (-1.8% vs. 2019).

In terms of stock, out of the 5 biggest Other Legacy TLDs by volume—.biz, .info, .mobi, .net and .org,—.org was the only one to grow (+1% vs. 2021). The performance of the others ranges from -1% for .net to -9% for .mobi.

In terms of creating operations, .info doubtlessly benefited from a promotional campaign resulting in a sharp increase (+21% vs. 2021) in the number of create operations. All the other major Legacy TLDs, including .com, posted a fall in create operations, from -8% to -10%.

ccTLDs are country-code Top Level Domains like .fr for France. There were a total of 129 million ccTLDs at the end of 2022, up +3.0% compared with 2021, following a fall of -3.8% in 2021 vs. 2020 and -0.9% in 2020 vs. 2019.

Even so, all of the major regions, with the exception of Asia-Pacific, which had posted substantial losses in 2020/2021 and turned positive again (+7%), are experiencing a slowdown in growth: North America (+5% in 2022 vs. 2021 against +6% in 2021 vs. 2020), Africa (+9% against +15%), Europe (+1% against +3%), and especially Latin America, with growth down from +18% to +4% this year.

There were 31 million new TLDs (nTLDs: generic TLD created after 2014) at the end of 2022, representing a +7.2% increase compared with 2021, following the two successive declines in 2021 (-9.4% vs. 2020) and 2020 (-1.0% vs. 2019).

nTLDs account for 9% of market share. Apart from a peak above 10% in mid-2020, this market share remains within the average over the past five years, generally between 8% and 10%, with no significant improvements or deteriorations.

| 2022 | COMM | GEN | GEO | OBR | CORP | Total | % | Var.21/22 |

|---|---|---|---|---|---|---|---|---|

| Identity Digital | 5 | 280 | 5 | - | 117 | 407 | 35% | +3 |

| GoDaddy Registry | 1 | 73 | 7 | 1 | 137 | 219 | 19% | + 21 |

| Verisign | - | 13 | - | - | 103 | 116 | 10% | - 4 |

| CentralNic | 1 | 70 | 7 | - | 28 | 106 | 9% | + 8 |

| Nominet | 1 | 7 | 2 | - | 55 | 65 | 6% | - 22 |

| GMO Registry | - | 1 | 6 | - | 40 | 47 | 4% | - 1 |

| - | 27 | - | - | 19 | 46 | 4% | - | |

| CORE | - | 5 | 7 | - | 7 | 19 | 2% | - |

| ZDNS | - | 12 | - | - | 6 | 18 | 2% | - 3 |

| Tucows Registry | - | 16 | - | - | 1 | 17 | 1% | + 17 |

| Afnic | - | - | 4 | 1 | 7 | 12 | 1% | - |

| Beijing Tele-info Network Tech. | - | 6 | - | - | 4 | 10 | 1% | + 1 |

| Domain Name Service | - | - | 4 | - | - | 4 | 0% | - |

| Others | 4 | 18 | 19 | - | 25 | 66 | 6% | - 11 |

| Total | 12 | 528 | 61 | 2 | 549 | 1 152 | - 4 |

With 407 nTLDs under management, Identity Digital (a group formed in 2021 by the successive buyouts of Afilias by Donuts and Donuts by Ethos Capital) controls 35% of existing nTLDs at 12/31/22, including 53% of Generics and 21% of .BRANDS. It’s interesting to note that the majority of .BRANDS were contributed by Afilias, and Generics by Donuts, forming a bipolar group whose business models can complement each other. In fact, .BRANDS tends to be invoiced on a flat-rate basis and is therefore not dependent on the economic climate, whereas Generics, which are often invoiced on a volume basis, are more subject to revenue fluctuations.

The 2nd largest registrar, GoDaddy Registry, manages 219 nTLDs (19%), and is the leader in the .BRANDS segment, with 25% of extensions in this segment.

The market shares of the next largest are declining rapidly, with the 13 leaders accounting for a total of 94% of nTLDs.

Generally speaking, positions do not vary much. Certain “accidents,” such as Nominet’s strategic shift or UNR’s sale of its nTLDs create opportunities, but the number of nTLDs changing hands remains limited in relation to the total number, and the players remain the same: Tucows Registry is one of the few newcomers.

Some back-end registries tend to specialize in Generics (Google, ZDNS…) or in .BRANDS (Verisign). Generally speaking, “pure” strategies do not often exist because, in 2012, the players did not have a clear vision of this still nascent market and simply seized the opportunities offered to them.

| 2022—millions | COMM | GEN | GEO | OBR | CORP | Total | % | Var. 21/22 |

|---|---|---|---|---|---|---|---|---|

| CentralNic | 0 | 14 284 | 70 | - | 8 | 14 362 | 47% | + 1 786 |

| Identity Digital | 12 | 5 818 | 27 | - | 12 | 5 869 | 19% | + 403 |

| GoDaddy Registry | 4 | 3 658 | 105 | 7 | 3 | 3 777 | 12% | + 1 292 |

| ZDNS | - | 2 336 | - | - | 0 | 2 336 | 8% | + 420 |

| GMO Registry | - | 1 528 | 192 | - | 1 | 1 720 | 6% | + 295 |

| - | 1 083 | - | - | 0 | 1 083 | 4% | - 905 | |

| Tucows Registry | - | 669 | - | - | 0 | 669 | 2% | + 669 |

| Domain Name Service | - | - | 172 | - | - | 172 | 1% | + 133 |

| Afnic | - | - | 38 | 64 | 3 | 105 | 0% | - |

| Beijing Tele-info Network Tech. | - | 91 | - | - | 0 | 91 | 0% | + 35 |

| CORE | - | 17 | 69 | - | 1 | 87 | 0% | + 2 |

| Nominet | 1 | 49 | 23 | - | 4 | 77 | 0% | - 1 690 |

| Verisign | - | 12 | - | - | 2 | 14 | 0% | + 1 |

| Others | 27 | 104 | 251 | - | 4 | 386 | 1% | - 76 |

| Total | 44 | 29 649 | 947 | 71 | 38 | 30 748 | + 2 069 |

Download the full study here.

Sponsored byCSC

Sponsored byVerisign

Sponsored byVerisign

Sponsored byWhoisXML API

Sponsored byRadix

Sponsored byDNIB.com

Sponsored byIPv4.Global