|

||

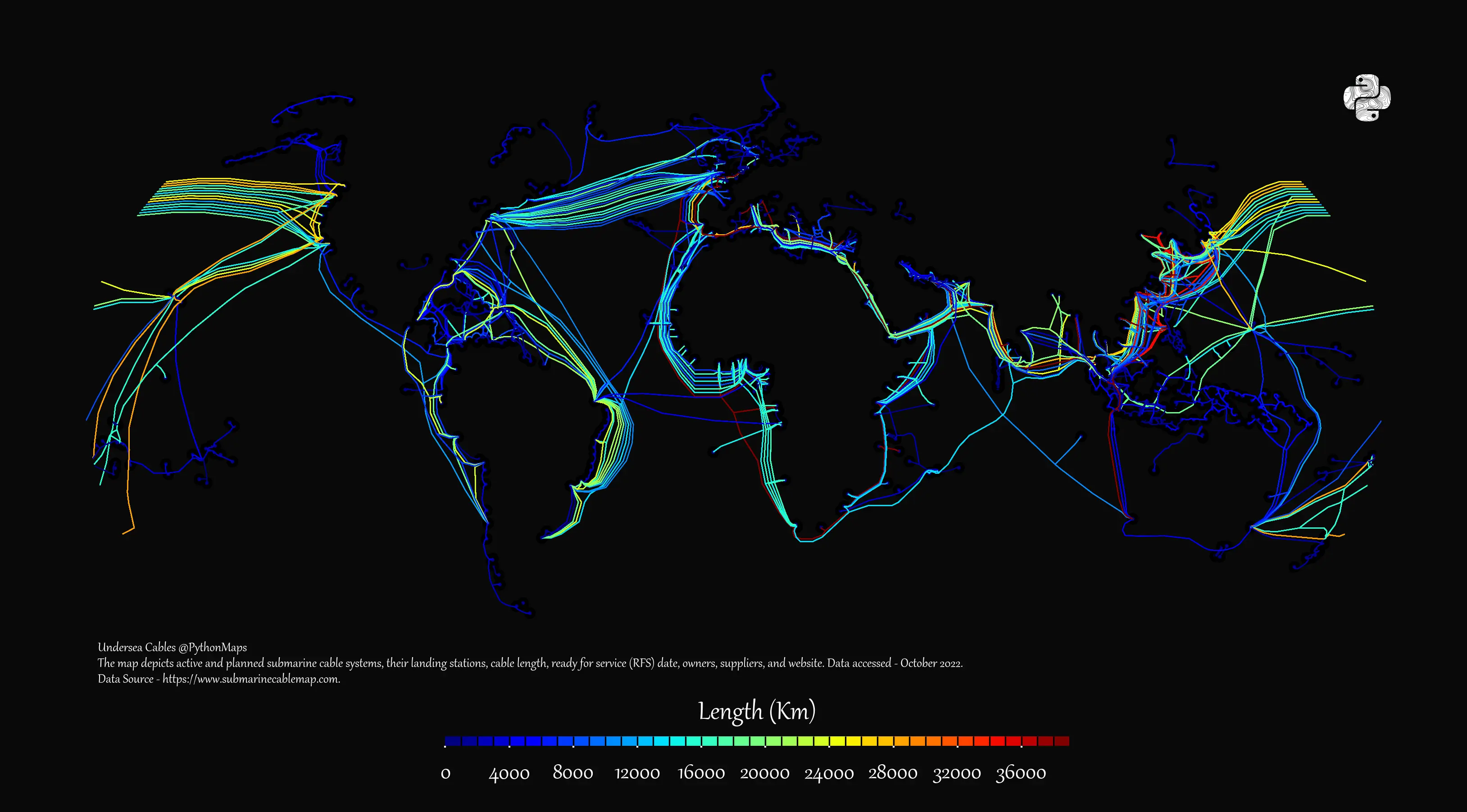

The global surge in artificial intelligence is fuelling an unprecedented wave of investment in subsea cables, the vital infrastructure that underpins 95% of international internet and communications traffic. As demand for cloud services and data-intensive AI models grows, technology giants are racing to build their own high-capacity networks beneath the ocean.

Record investment: Between 2025 and 2027, investment in new undersea cables is projected to reach $13 billion—nearly double the amount spent in the previous three years. Major tech firms including Meta, Amazon, Google and Microsoft are leading the charge. Meta’s Project Waterworth, a 50,000km-long system linking five continents, will be the world’s longest private cable. Amazon’s Fastnet cable, connecting the U.S. and Ireland, will deliver bandwidth sufficient for over 12 million high-definition video streams.

Technical necessity: These cables are critical not just for performance but also for resilience. Unlike satellite links, which are costlier and slower, subsea cables provide the high-throughput, low-latency connectivity needed for AI operations and cloud services.

Rising threats: Yet, the infrastructure’s importance also makes it vulnerable. Cable damage—whether accidental or deliberate—can disrupt financial systems and internet access across entire regions. Suspected sabotage incidents have risen, particularly in the Baltic Sea and near Taiwan, aligning with geopolitical tensions involving Russia and China. In response, NATO has launched operations like “Baltic Sentry” to safeguard underwater networks.

Security response: The U.S. government is also tightening scrutiny of foreign participation in undersea cable projects, citing espionage risks. Firms linked to China are increasingly excluded from U.S.-connected systems, while American tech companies deny involvement with Chinese suppliers.

As digital dependency deepens, the contest over subsea infrastructure is becoming as strategic as it is technological. For global connectivity—and global security—the stakes have never been higher.

Sponsored byRadix

Sponsored byCSC

Sponsored byVerisign

Sponsored byVerisign

Sponsored byDNIB.com

Sponsored byWhoisXML API

Sponsored byIPv4.Global