|

||

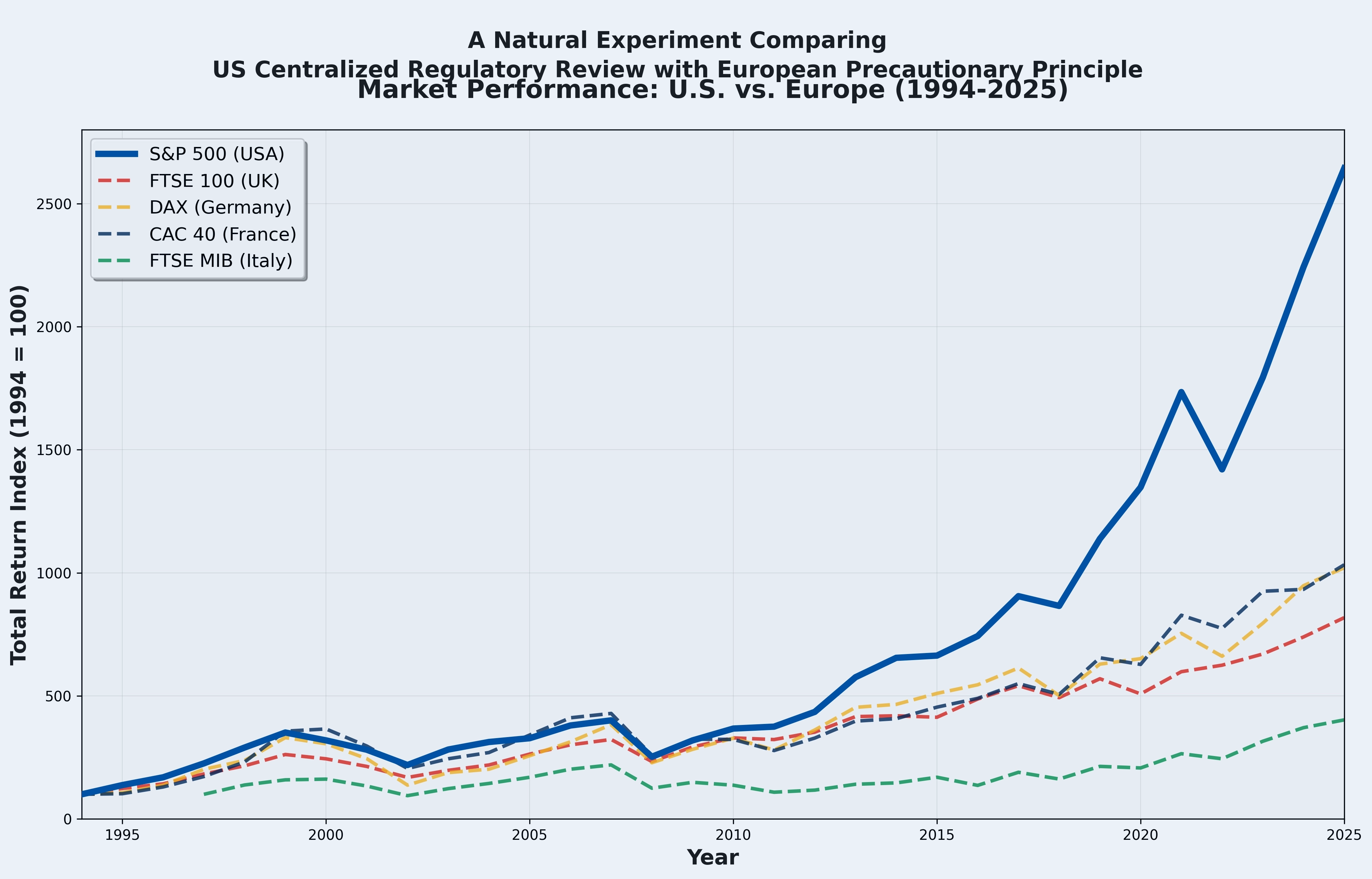

A Natural Experiment Comparing US Centralized Regulatory Review with European Precautionary Principle`

America’s innovators set its potential. America’s regulators determine its reality. Whether America’s economy continues to soar or sinks into European-style decrepitude will be determined by our regulatory policies.

For three decades, this truth has played out in a natural experiment comparing two fundamentally different approaches to governing innovation. The United States embraced centralized regulatory review—requiring evidence, demanding cost-benefit analysis, high-quality, validated models, and trusting markets under rational oversight. Europe chose the Precautionary Principle—assuming technologies are guilty until proven innocent, prioritizing theoretical risks over demonstrated benefits.

The results and America and Europe’s divergent futures are visible in a single chart.

Since 1994, as the digital revolution gathered momentum, the United States operated under a distinctive regulatory framework built on three pillars: Executive Order 12866, the Paperwork Reduction Act, and the Information Quality Act. These measures, championed by [Jim Tozzi and colleagues at the Center for Regulatory Effectiveness, established what scholars call “centralized regulatory review”—a system requiring agencies to demonstrate that regulatory benefits justify their costs.

Europe embraced the Precautionary Principle, which holds that new technologies must prove their safety before deployment, even in the absence of scientific evidence of harm. Now enshrined in EU treaties and embodied in regulations like GDPR and the [AI Act, this principle prioritizes caution over experimentation.

The market data reveals the outcome. An investor who placed $100 into the S&P 500 in 1994 would hold $2,643 today—a 26.4-fold return. The same investment in Germany’s DAX would be worth $1,021—less than half. France’s CAC 40 delivered $1,033, the UK’s FTSE 100 just $818, Italy’s FTSE MIB a mere $402.

This isn’t speculation—it’s prosperity measurement. Market performance reflects businesses’ ability to innovate, create employment, and deliver consumer value. It represents pension funds, retirement accounts, and middle-class economic foundations. The US’s 2.6x outperformance versus Germany and France, and 3.2x advantage over the UK, translates directly into substantially wealthier American families.

America’s regulatory advantage rests on three legal pillars, each developed through decades of bipartisan consensus.

Executive Order 12866, issued by President Clinton in 1993, requires agencies to adopt regulations “only upon a reasoned determination that the benefits of the intended regulation justify its costs.” It mandates that agencies “select those approaches that maximize net benefits” and design regulations “in the most cost-effective manner.” The order created the Office of Information and Regulatory Affairs (OIRA) within OMB to review significant regulations before implementation.

Every administration from Nixon through Trump has built and reinforced this system. As the Center for Regulatory Effectiveness documents in “The 50th Anniversary of Centralized Regulatory Review,” Time Magazine identified Reagan’s Executive Order 12291 as among nine executive orders that “changed the course of America.”

The Paperwork Reduction Act, championed by Tozzi during his service across five presidential administrations, grants OIRA authority to review information collection requirements that regulations impose on businesses and citizens. This statute prevents agencies from burying innovation under compliance paperwork and forces regulators to justify every form, data request, and reporting requirement.

The Data (Information) Quality Act, which Tozzi is widely credited with creating, requires federal agencies to ensure “quality, objectivity, utility, and integrity of information” they disseminate. It enables public challenges to regulatory decisions based on faulty or biased data. Scholars analyzing Tozzi’s policy entrepreneurship identify the Data Quality Act as “one of the most significant regulatory reforms over the past twenty-five years” that “changed the balance of power” in regulatory processes.

These measures create what Bruce Levinson of the Center for Regulatory Effectiveness describes in his academic work on centralized regulatory review: a framework requiring evidence, demanding cost-benefit analysis, and maintaining centralized oversight to ensure consistency and rationality across federal agencies.

The European Union took the opposite path. The Precautionary Principle operates on the premise that potential risks—regardless of their speculative nature—justify regulatory intervention. This approach “could distort regulatory priorities, justify protectionist measures, and stifle further innovation”.

The EU AI Act exemplifies this philosophy. It imposes strict risk classifications and high compliance costs, navigable only by large corporations, forcing startups to prove technologies safe before experimentation. Consequences: over 80% of global AI investment flows to the US and China, while Europe receives just 7%. Since 2015, Europe’s productivity growth averaged 0.7% annually—less than half the US rate.

The precautionary mindset extends beyond AI. Europe’s biotechnology approval process ranks among the world’s slowest. Experimental energy technologies encounter suffocating red tape. Nearly one-third of European unicorn startups relocate abroad, predominantly to the United States, seeking favorable regulatory environments.

As artificial intelligence emerges as potentially the most transformative technology since the internet, America confronts a choice: maintain our proven centralized regulatory review system, or follow Europe toward precautionary paralysis.

Some advocate importing Europe’s AI Act framework—ex-ante approval requirements, broad prohibitions, and presumptions that AI systems are guilty until proven innocent. They cite theoretical risks and demand innovation wait until all uncertainties resolve.

The chart tells a different story. It demonstrates outcomes when trusting markets, innovation, and human ingenuity under rational, evidence-based oversight versus demanding safety proof before permitting experimentation. It reveals the Precautionary Principle’s cost: reduced prosperity, diminished opportunity, and technological stagnation.

The American regulatory system isn’t laissez-faire. Executive Order 12866 requires rigorous analysis. The Paperwork Reduction Act prevents bureaucratic excess. The Information Quality Act ensures decisions rest on sound science. Together, they create what Tozzi and Levinson term “regulating the regulators”—ensuring rules serve public interest rather than regulatory convenience or political fashion.

Thirty-one years of data constitute a powerful natural experiment. Two advanced economies adopted fundamentally different approaches to regulating innovation. Results are unambiguous: America’s centralized regulatory review framework delivered vastly superior economic outcomes.

The framework that enabled digital transformation—creating wealth, employment, and opportunity for hundreds of millions of Americans—can guide AI innovation safely and productively.

The alternative appears in the chart: European markets underperforming the United States by 2-3x across three decades. That gap represents trillions in forgone prosperity—pension accounts that could have grown larger, businesses that could have launched, innovations that never reached markets.

America’s economic future depends on governing artificial intelligence under Executive Order 12866, the Paperwork Reduction Act, and the Information Quality Act—not under the economically harmful, scientifically unjustified Precautionary Principle that constrained Europe for a generation.

The chart makes the case. The question is what future for their countries will policymakers choose?

Sponsored byDNIB.com

Sponsored byCSC

Sponsored byRadix

Sponsored byWhoisXML API

Sponsored byVerisign

Sponsored byVerisign

Sponsored byIPv4.Global