|

||

|

||

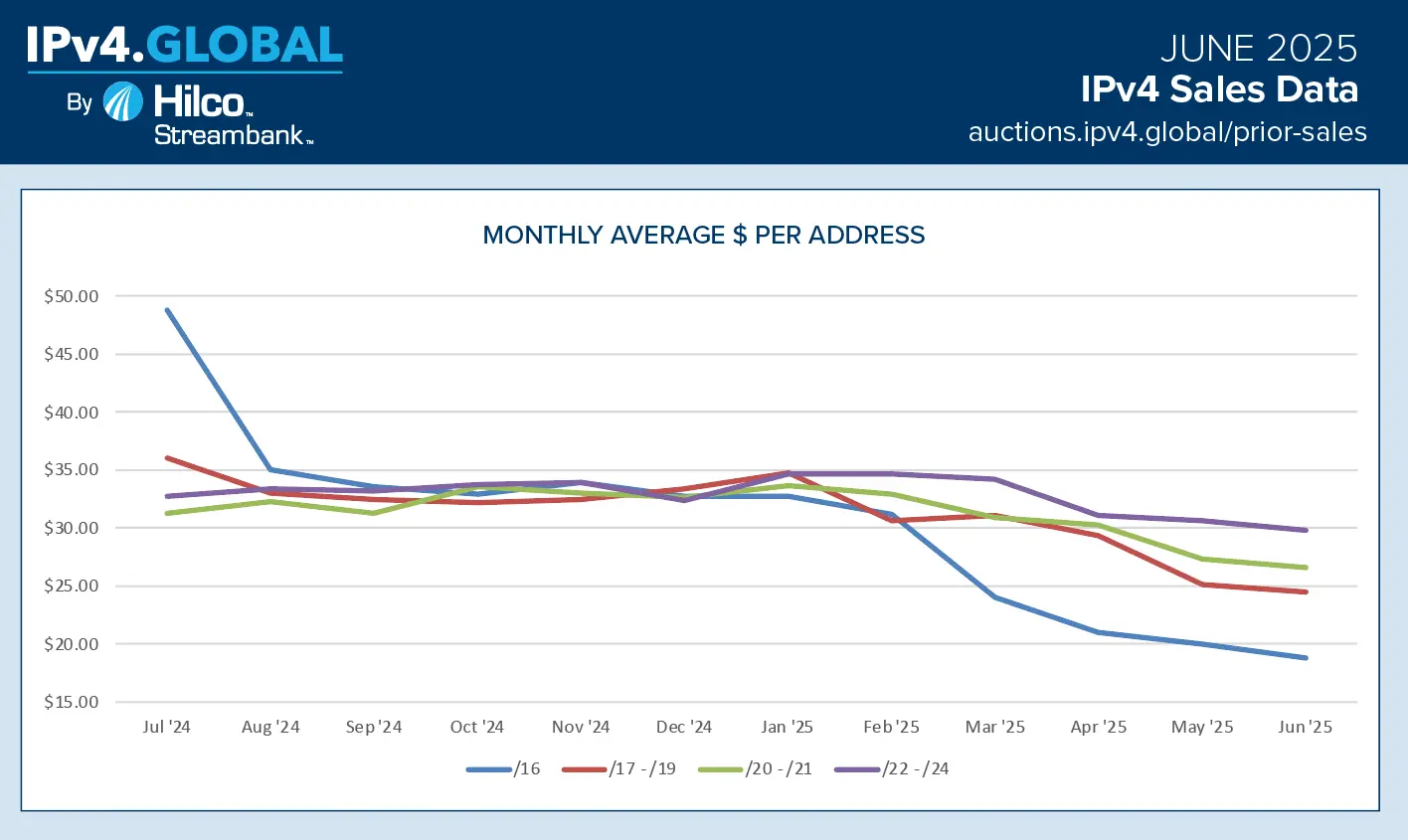

After years of steady ascent, the market for IPv4 addresses is experiencing an uncharacteristic softening. According to new data from IPv4.Global by Hilco Streambank, the average monthly price per address has declined across all block sizes, with the most striking plunge seen in the larger /16 blocks. In June 2025, the price for a /16 address dipped below $20 for the first time since 2019—a psychological and financial milestone for a commodity that had grown increasingly scarce.

The chart accompanying this report shows a clear downward trend over the past year. While all address block categories—from /17 through /24—exhibited mild price easing, the /16 segment (denoted in blue) saw the steepest fall, dropping from nearly $50 in July 2024 to under $20 by June 2025. Prices for smaller blocks, such as /22–/24, remained relatively stable until early 2025, before beginning a gradual decline.

This drop is not driven by a collapse in demand. IPv4 addresses remain a critical resource for internet service providers, data centres, and enterprise networks that have yet to complete their transition to IPv6. Instead, the market appears to be adjusting to an increase in available supply. Whether due to divestitures by large corporations or more aggressive recycling of dormant address space, the inventory of IPv4 assets has risen, pulling down prices through classic market mechanics.

Such pricing dynamics reflect a maturing secondary market—one that, while still lucrative, is increasingly influenced by the volume of participants seeking to monetize previously idle allocations. If the current trend continues, firms that have hoarded addresses may find diminishing returns.

Sponsored byRadix

Sponsored byVerisign

Sponsored byIPv4.Global

Sponsored byWhoisXML API

Sponsored byDNIB.com

Sponsored byVerisign

Sponsored byCSC