|

||

|

||

IPv4.Global‘s latest market report reveals that while IPv4 prices declined throughout 2025, strong demand and rising transaction volume underscore a resilient and evolving address marketplace.

As 2025 drew to a close, the market for IPv4 addresses presented a paradox. While prices across all block sizes declined steadily—reaching multi-year lows by December—demand remained remarkably resilient. This decoupling of price from volume suggests a maturing, liquid market where buyer sophistication and broader market participation are redefining value dynamics.

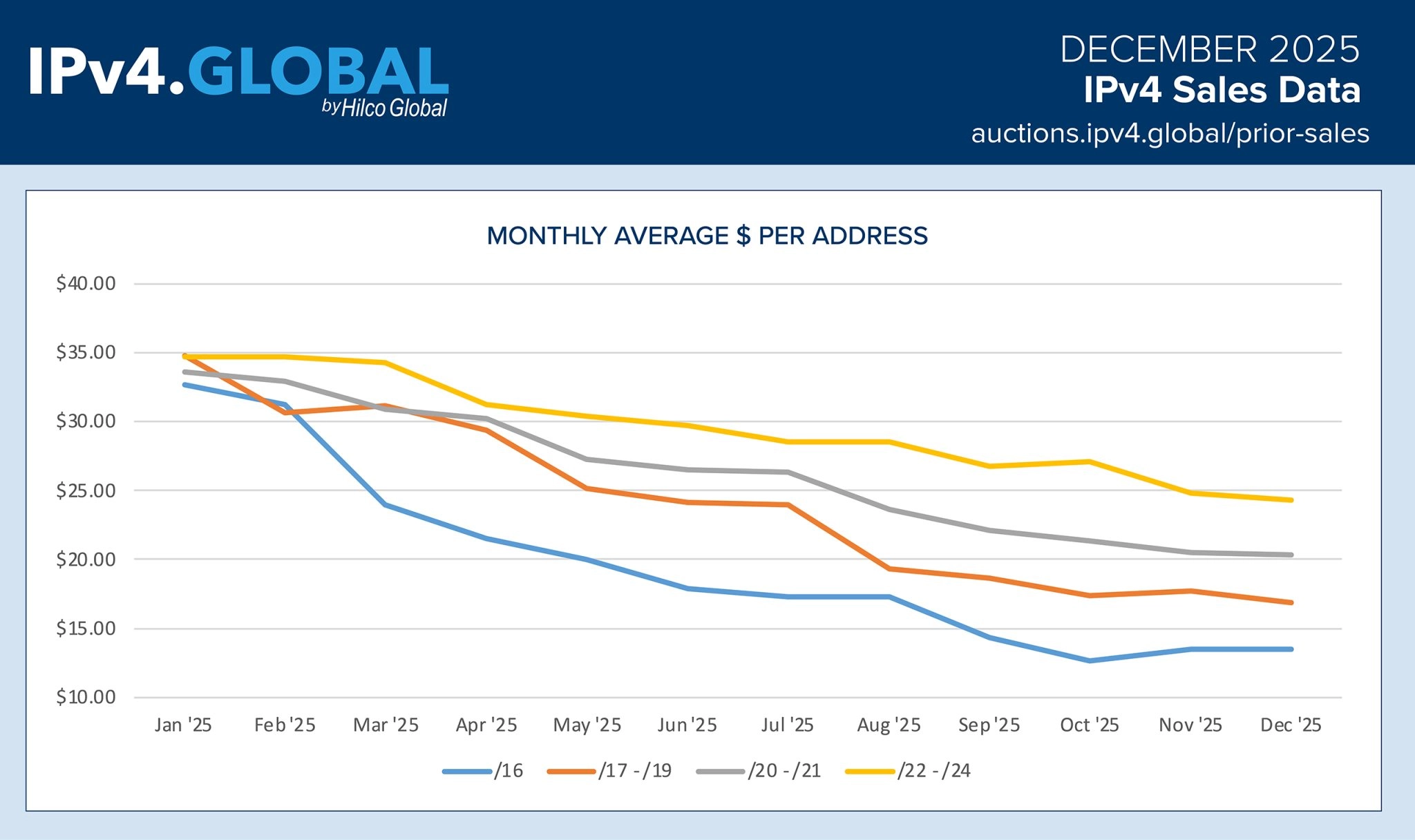

Across 2025, IPv4 address prices fell consistently for all block sizes, with larger blocks (/16 and above) experiencing the sharpest contractions. As the graph shows, /16 blocks began the year near $33 per address, only to fall below $13 by Q4—a decline of over 60%. Mid-size blocks (/17–19 and /20–21) followed similar trajectories, albeit with slightly less volatility, ending the year closer to $16 and $21 per address, respectively. Smaller blocks (/22–24), often favored by new entrants and hosting providers, saw more modest declines, suggesting persistent demand at the retail end of the market.

This trend aligns with broader industry analysis, which attributes the pricing slump to a combination of surplus inventory, reduced urgency around IPv6 migration, and tightening IT budgets across sectors. Still, this does not point to a market in distress.

Contrary to price movements, transactional data reveals a healthy volume of sales, particularly in private transactions. The number of active buyers increased meaningfully in 2025, reflecting a diversifying buyer pool that now includes cloud-native firms, regional ISPs, and digital infrastructure startups. Many of these entities are pursuing strategic address acquisitions not for speculative resale, but for long-term operational use.

Additionally, high levels of market liquidity—measured both in transaction frequency and geographic breadth—signal a marketplace that is functioning efficiently. Buyers are becoming more discerning, leveraging the price flexibility of a softened market to meet evolving address needs. Sellers, meanwhile, continue to find ready takers, even amid price contractions.

This stable activity is underpinned by the professionalism of brokers and platforms facilitating the transactions. IPv4.Global’s own data reflect not only consistent buyer engagement but also increasing transaction velocity—a sign that, even in decline, IPv4 remains a critical infrastructure asset.

The reported pricing figures capture both online and private sales, and may include bundled transactions with negotiated terms not visible in unit pricing. Notably, the dataset excludes LACNIC-region addresses, which could otherwise influence average pricing. Furthermore, prices are reported as of agreement dates rather than final transfer, which may create minor temporal mismatches in monthly reporting.

Looking ahead, the IPv4 market appears poised for a period of recalibration rather than contraction. Prices may continue to soften in early 2026, especially if broader macroeconomic conditions remain tight. However, the underlying fundamentals—broad demand, expanding buyer profiles, and transaction health—indicate a stable foundation.

Sponsored byRadix

Sponsored byVerisign

Sponsored byCSC

Sponsored byDNIB.com

Sponsored byVerisign

Sponsored byWhoisXML API

Sponsored byIPv4.Global