|

||

|

||

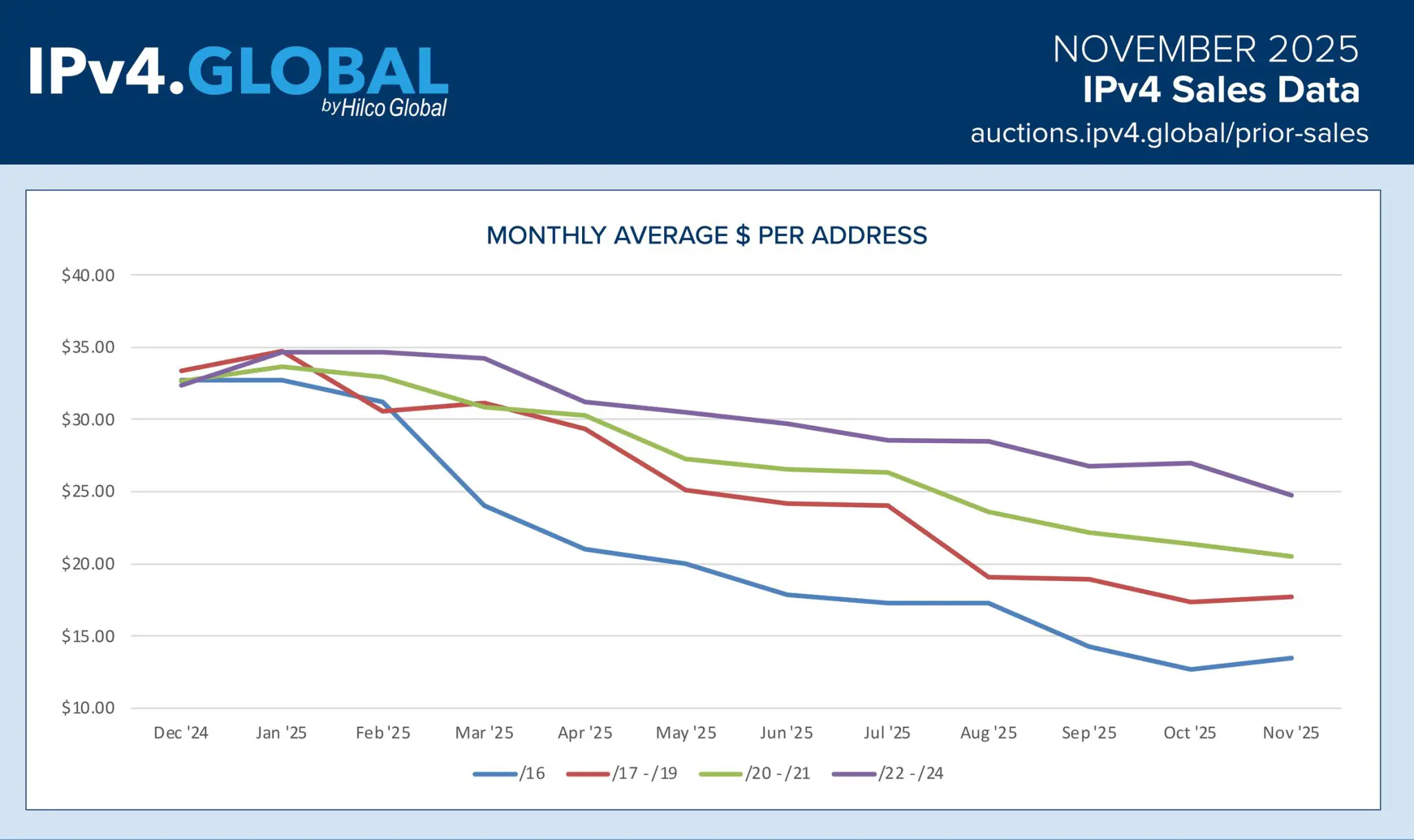

November 2025 Market Update from IPv4.Global: Small block prices fall further in November while demand and market fundamentals remain strong.

The latest data from IPv4.Global shows a continuation of the year-long trend: IPv4 address prices, particularly for small and medium-sized blocks, are declining gradually. According to our November 2025 report, the monthly average price per address dropped across all block sizes, with the steepest falls seen in /16 blocks, which dipped below $15 per address for the first time this year.

Notably, the price gap between smaller blocks (/22–/24) and larger allocations (/17–/19 and /20–/21) has narrowed. The smaller blocks, which previously commanded a premium due to their flexibility and accessibility, have seen sustained price erosion over the past six months. As of November, /22–/24 prices have fallen to just under $30 per address—down from nearly $35 at the start of the year.

In contrast, larger block categories, including /20–/21 and /17–/19, have seen a gentler rate of decline. This suggests a partial stabilization in that segment of the market, potentially reflecting bulk-buying demand from infrastructure providers and cloud companies seeking cost-effective address space at scale.

Despite the downward pressure on prices, underlying market dynamics remain strong. Transaction volume has held steady, and buyer interest across online and private channels continues to be robust. The persistence of demand underscores the continuing reliance on IPv4, even as IPv6 adoption inches forward.

This resilience echoes patterns observed in previous quarters. As noted in our earlier market updates, the IPv4 market has consistently shown that lower prices do not equate to weak fundamentals. Rather, the data suggests that the market is undergoing a slow correction as buyers adjust expectations and sellers compete in a more price-sensitive environment.

Looking ahead, the modest convergence in price points across block sizes could signal more competitive dynamics in early 2026. While volatility may persist, the combination of stable demand and easing prices suggests a healthy, functioning market—albeit one facing long-term pressure from the eventual transition to IPv6.

For more insights, view our previous reports on CircleID and IPv4.Global.

Sponsored byVerisign

Sponsored byRadix

Sponsored byWhoisXML API

Sponsored byVerisign

Sponsored byDNIB.com

Sponsored byIPv4.Global

Sponsored byCSC