|

||

|

||

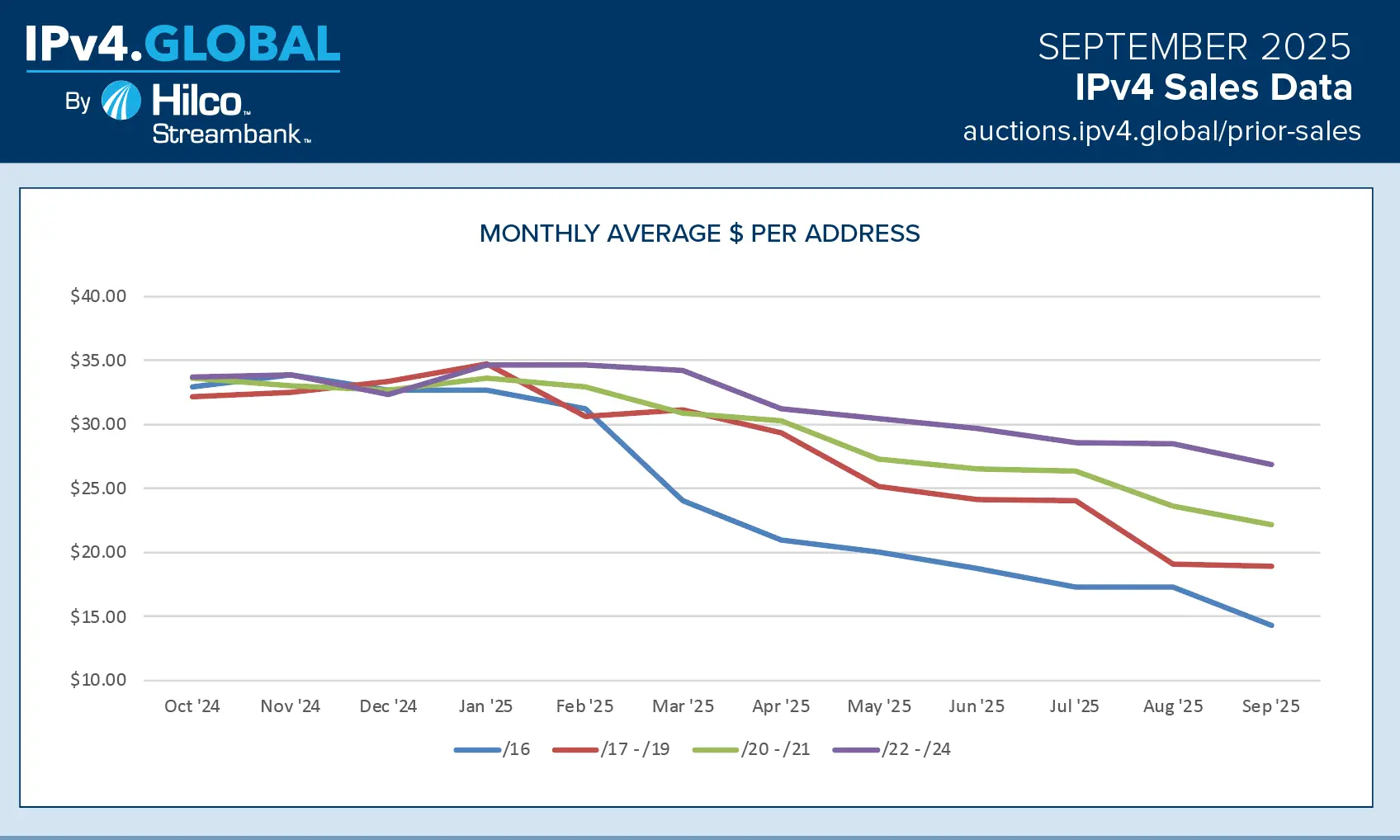

In the latest analysis from IPv4.Global, the average price of IPv4 addresses continued its gradual descent through the third quarter of 2025. Yet despite this ongoing price adjustment, overall market activity remains steady—driven by robust supply and sustained demand.

According to the September report, which draws on a blend of online and private sales, prices for all block sizes declined from their January highs. The largest drop was observed in the /16 blocks, which have fallen from nearly $33 per address in January to below $15 by September. Smaller blocks, such as /22 to /24, have proven more resilient, with prices hovering near $28 per address, down from a high of roughly $35 earlier this year.

This divergence highlights a widening price gap between larger and smaller block sizes—a trend previously explored in this CircleID analysis. Larger blocks, typically used by data centers and ISPs, are being sold off at increasing volume as holders seek liquidity. Meanwhile, smaller blocks continue to attract a premium due to their relative scarcity and appeal to end users seeking quick deployment with minimal routing complexity.

The downward trend in pricing has been evident since the start of Q2. As previously reported, the influx of available addresses in the secondary market has exerted downward pressure on prices. Yet despite this, transaction volumes remain healthy, suggesting that the market is adjusting—not collapsing.

This is consistent with broader observations in August, where resilient demand helped stabilize overall market dynamics, even amid pricing fluctuations. Buyers, particularly those in cloud services and content delivery, continue to acquire addresses at volume. Sellers, facing rising operational costs and regulatory uncertainty, appear increasingly motivated to part with unused allocations.

As Q4 begins, the IPv4 market remains dynamic. While prices have declined, the fundamentals—active buyers, ample listings, and the absence of alternative protocols at scale—continue to support a functioning, if evolving, marketplace.

For the latest transactional data and live market activity, visit IPv4.Global’s prior sales tracker.

Sponsored byDNIB.com

Sponsored byWhoisXML API

Sponsored byVerisign

Sponsored byIPv4.Global

Sponsored byVerisign

Sponsored byCSC

Sponsored byRadix