|

||

|

||

The IPv4 market in 2025 saw steady prices, rising leasing activity, and platform innovation. IPv4.Global played a central role in shaping and documenting these evolving market dynamics.

The year 2025 marked a period of meaningful recalibration in the IPv4 address market. Amid global demand fluctuations and economic uncertainty, IPv4.Global observed significant shifts in both pricing and participation. While headline figures reveal a marked decline in address block prices, broader metrics suggest that market fundamentals remained robust, with transactional activity and buyer interest proving resilient.

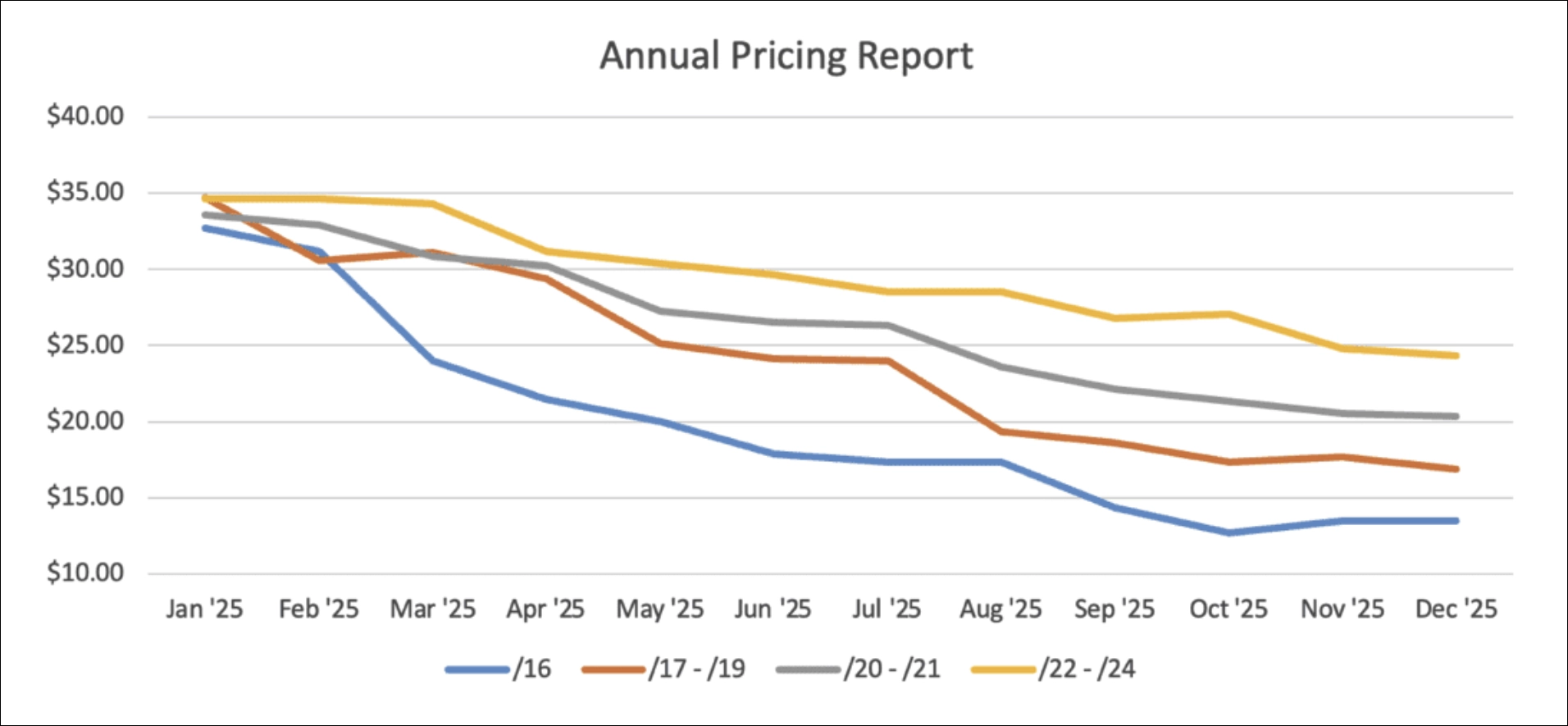

Throughout 2025, IPv4 block pricing followed a consistent downward trajectory. The steepest declines were seen in large address blocks—particularly those of /16 and greater—which reached their lowest levels in over a decade. Smaller blocks also saw material price adjustments, with every size tier (from /16 through /24) experiencing gradual but steady devaluation across the year. By December, average market rates had fallen well below those at the start of the year, reflecting a widespread reassessment of asset valuations.

Despite this correction, market participants remained active. The softening of prices, rather than deterring engagement, appears to have made entry more attractive to a wider array of buyers. Such a dynamic points less to a loss of confidence and more to a normalization after a period of heightened valuations.

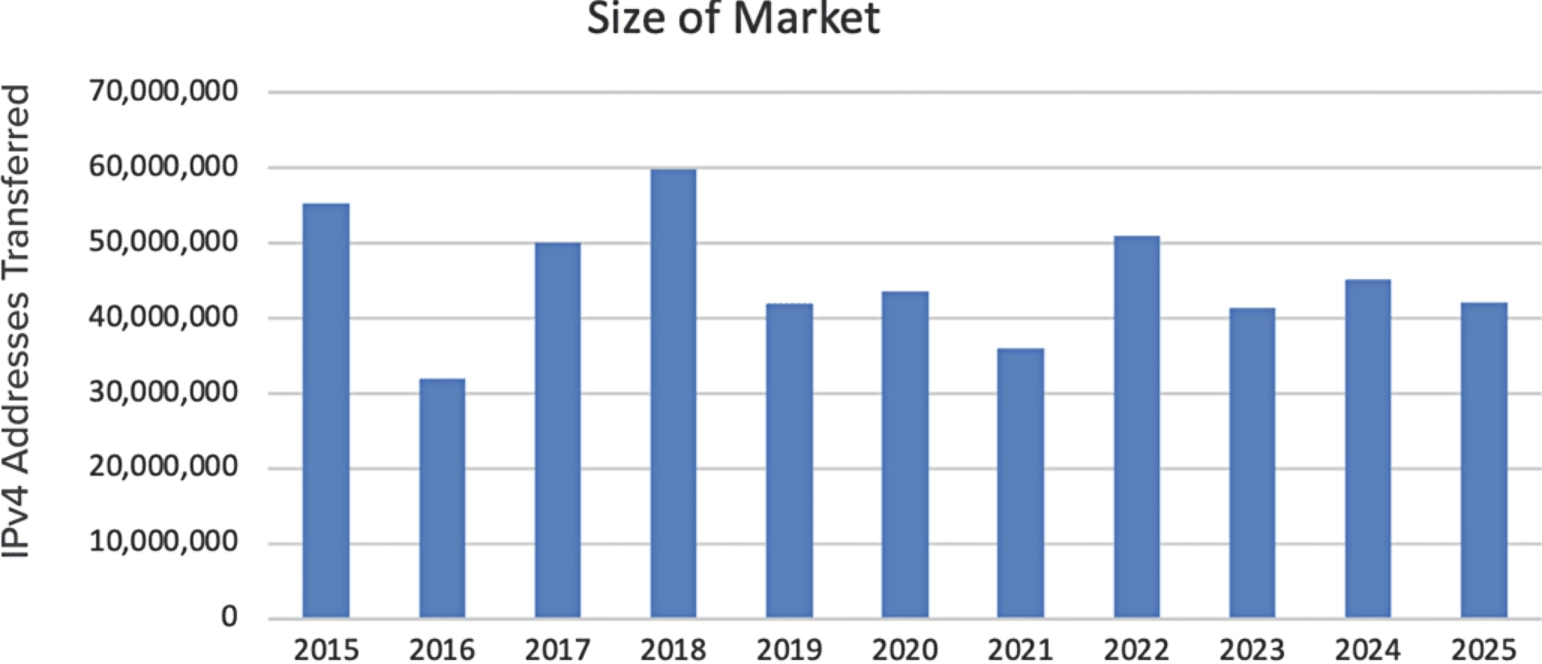

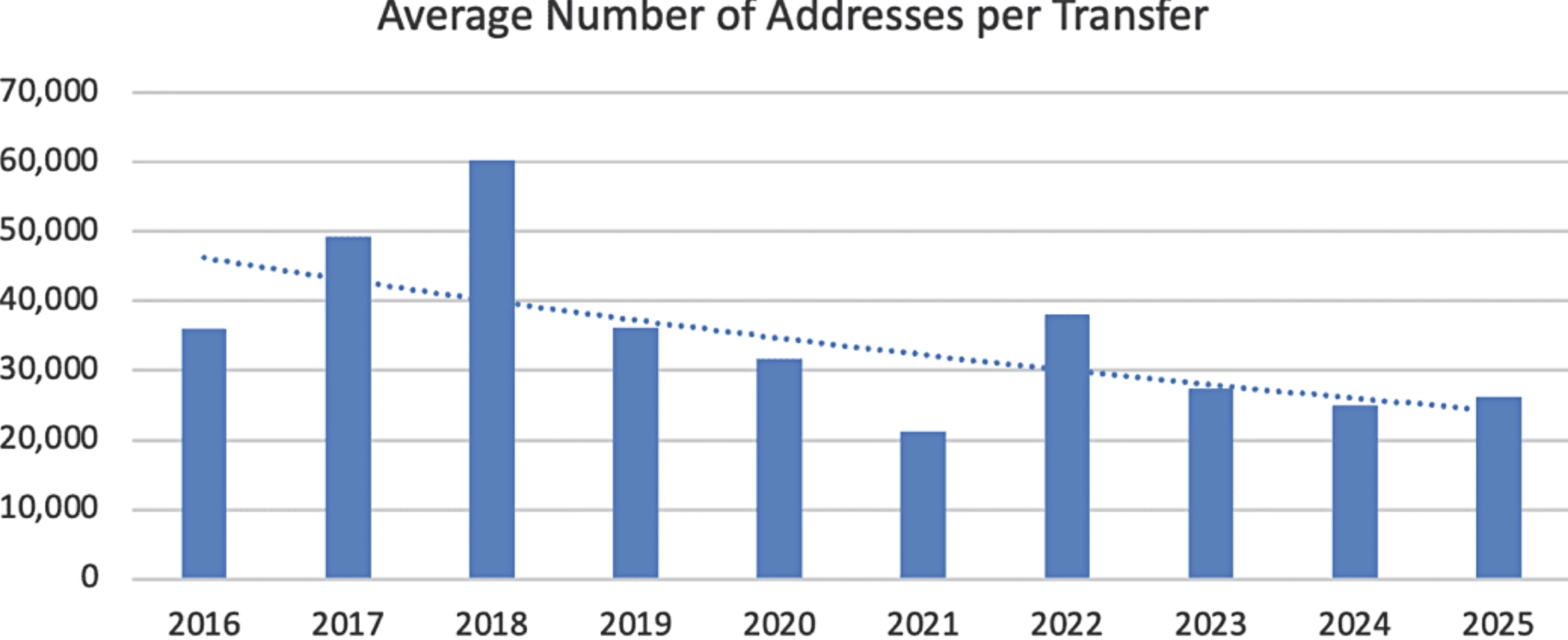

Counterbalancing the price decline was the continued strength in transaction volume. Over 40 million IPv4 addresses were transferred in 2025, aligning closely with figures from previous years and underscoring enduring demand. Notably, the composition of these transactions reveals a broadening of market participation: the average number of addresses per transfer remained near 26,000—slightly below the typical /17 block—indicating a healthy mix of both enterprise-level and mid-sized buyers.

This consistent transactional pace, even amid falling prices, suggests that buyers are increasingly viewing IPv4 addresses not simply as speculative assets but as essential infrastructure inputs. As cloud adoption, internet-of-things (IoT) deployments, and enterprise digitization initiatives accelerate, demand for IPv4 remains functionally grounded.

In structural terms, the IPv4 market in 2025 displayed signs of maturation. The pool of active buyers expanded, suggesting not only greater awareness but also growing comfort with the complexities of IP address transfers. Additionally, transaction activity remained geographically diverse, with emerging markets continuing to represent a growing share of volume.

These factors point to a more decentralized and democratized marketplace. Lower prices may have helped reduce barriers to entry, while the consistency of demand indicates that IP addresses remain vital for organizations navigating digital expansion.

As the market enters 2026, the interplay between subdued pricing and heightened activity is likely to persist. If historical trends hold, the pricing floor reached in late 2025 could pave the way for stabilisation, especially if buyer-side interest continues apace. At the same time, the increasing sophistication of market participants and the operational necessity of IPv4 addresses should support ongoing liquidity.

For industry stakeholders—ranging from network operators and ISPs to investors and policy observers—the 2025 market serves as a useful barometer: prices may fluctuate, but utility, demand, and transactional resilience remain the core pillars of this evolving digital resource market.

Sponsored byVerisign

Sponsored byCSC

Sponsored byVerisign

Sponsored byIPv4.Global

Sponsored byDNIB.com

Sponsored byWhoisXML API

Sponsored byRadix