|

||

|

||

The market for IPv4 addresses, already constrained by finite supply is undergoing a period of subtle yet significant transition. Data from IPv4.Global’s July 2025 report reveals a continuing decline in average prices per address—particularly among larger blocks—even as transaction volume sees a notable surge.

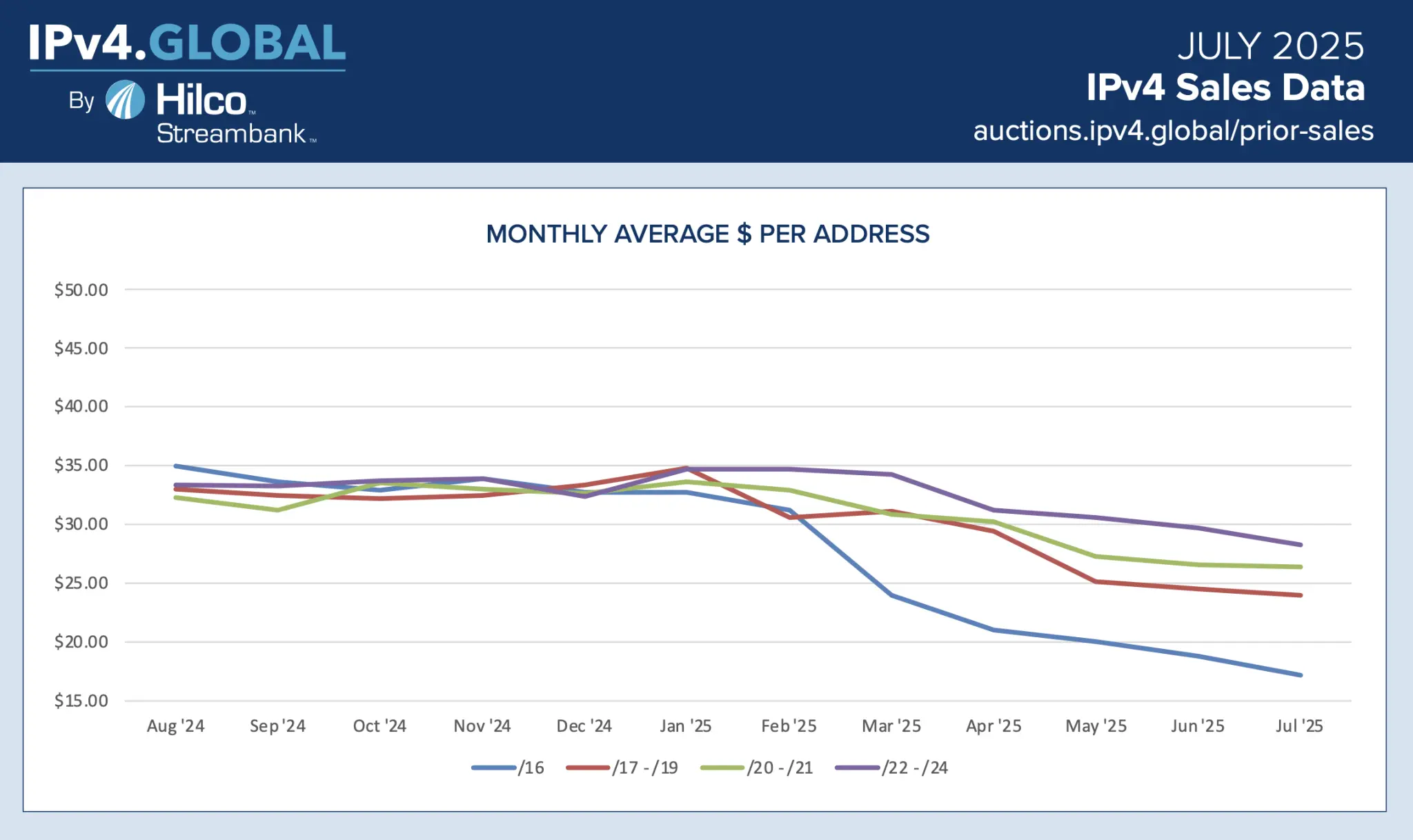

According to the data, average prices across all block sizes remained largely flat through late 2024 and into early 2025. However, by February this year, larger blocks—especially /16s—began a pronounced decline, dropping from around $33 per address in January to about $18 by July. Mid-sized blocks, such as /17 through /21, also saw a tapering off in price, though to a lesser extent. Smaller blocks, like /22 to /24, have proven relatively resilient, maintaining a higher average value of roughly $28 as of July.

This divergence suggests a bifurcated market, in which smaller blocks, often favored by hosting providers and edge-computing platforms, continue to command premiums, while bulk buyers of large blocks—typically telecoms or cloud infrastructure firms—are seeing lower prices.

The pricing dip, particularly in the larger segments, reflects an ongoing build-up of supply. While the exhaustion of the IPv4 address pool has long been anticipated, speculative holding and the recycling of dormant blocks have temporarily softened the scarcity narrative. As sellers continue to offload surplus allocations, prices have correspondingly adjusted downward.

Yet, despite falling prices, demand appears to be growing. IPv4.Global reports a 32% increase in the number of transactions in July compared to the monthly average—98 deals versus the standard 73. This uptick underscores a growing appetite for IPv4 real estate, likely driven by continued digital infrastructure expansion in regions where IPv6 adoption remains sluggish.

The asymmetry between pricing and demand raises questions about market dynamics. One plausible interpretation is that buyers are sensing a floor in pricing and are moving to capitalise while the market remains favourable. Alternatively, the rise in transactions may reflect broader fragmentation—smaller firms or regional ISPs acquiring addresses in smaller, more affordable chunks, rather than bulk deals led by hyperscalers.

It is worth noting that these figures do not capture the full global picture. The report excludes LACNIC-regulated addresses, which cover Latin America and parts of the Caribbean. Additionally, many sales are bundled or privately negotiated, making granular comparisons more opaque.

Still, the trends are instructive. As IPv4 scarcity continues to collide with uneven IPv6 deployment, pricing remains vulnerable to supply-side shifts. Should global IPv6 adoption accelerate—or should regulators impose stricter controls on IP trading—further corrections may lie ahead.

A more detailed breakdown can be found at IPv4.Global’s transaction history.

Sponsored byDNIB.com

Sponsored byIPv4.Global

Sponsored byRadix

Sponsored byVerisign

Sponsored byVerisign

Sponsored byWhoisXML API

Sponsored byCSC